Build Your Own Custom Discounted Cashflow Model

Here is a quick primer on how to build your own sophisticated DCF Model using our free App "FundSpec" available on the AppStore and GooglePlay.

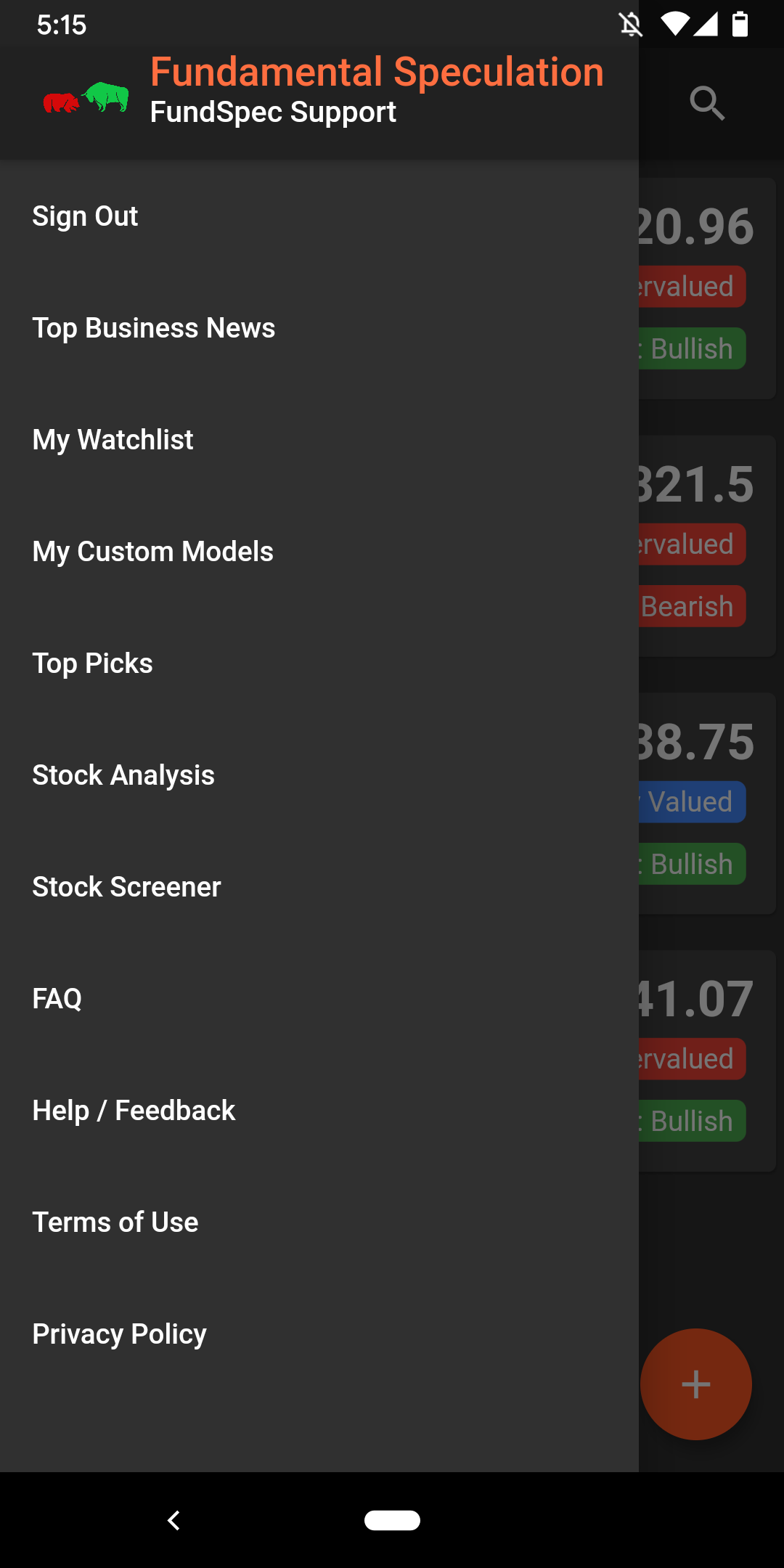

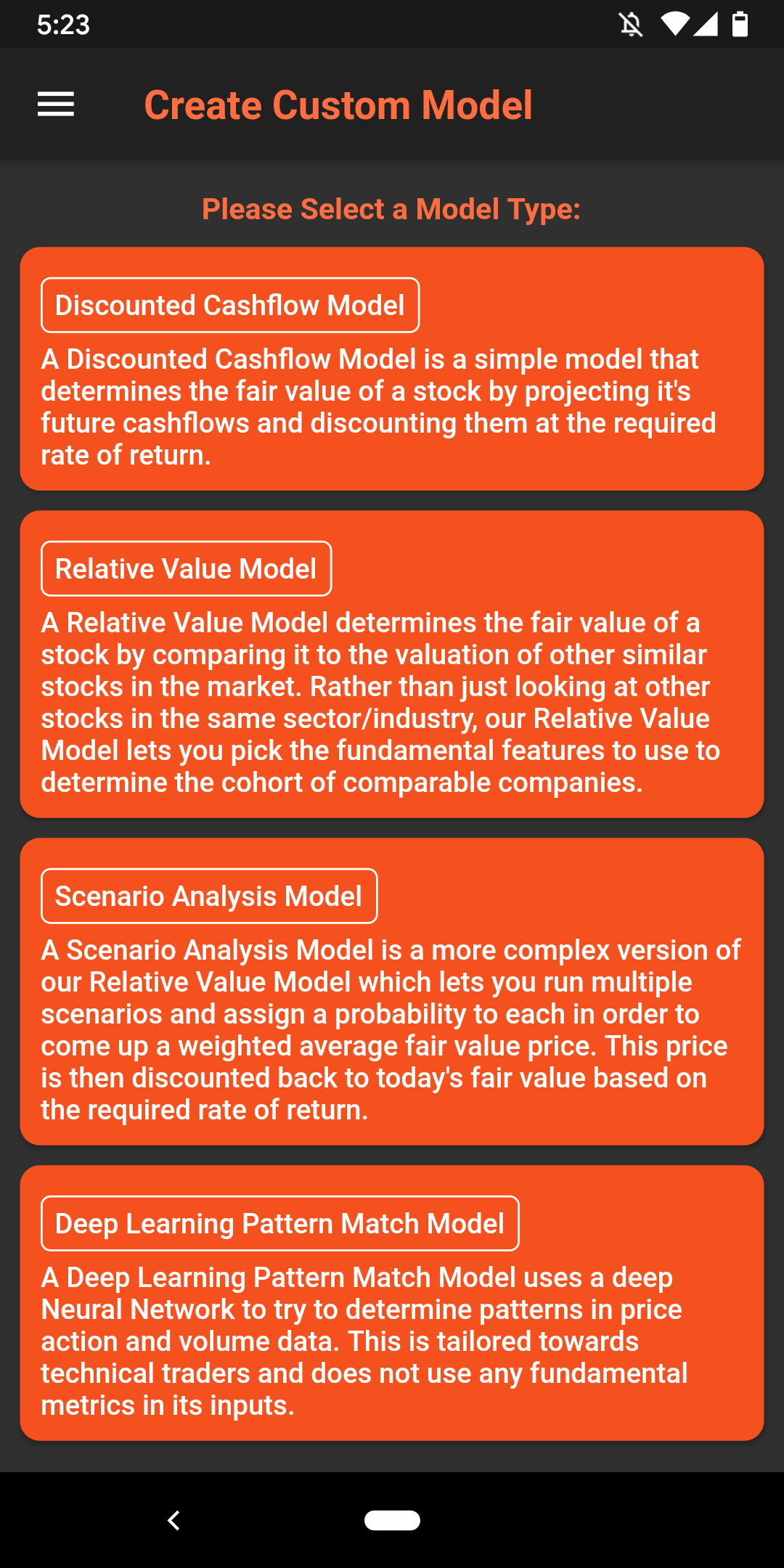

Step 0: Download our free app FundSpec on the AppStore & Google Play. Hit the menu button on the top left and select "My Custom Models" to create a new model. Select the Discounted Cashflow Model from the options shown.

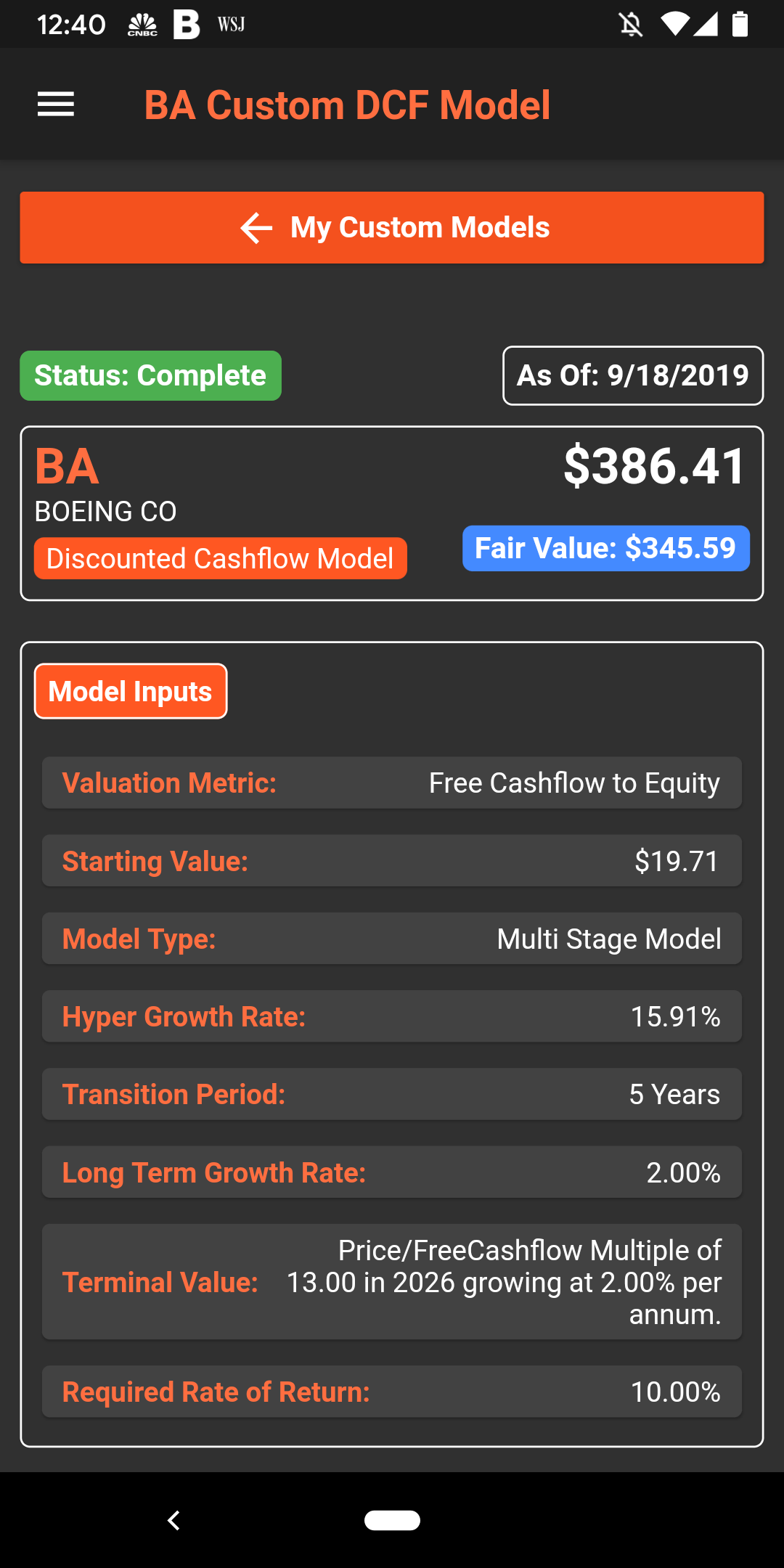

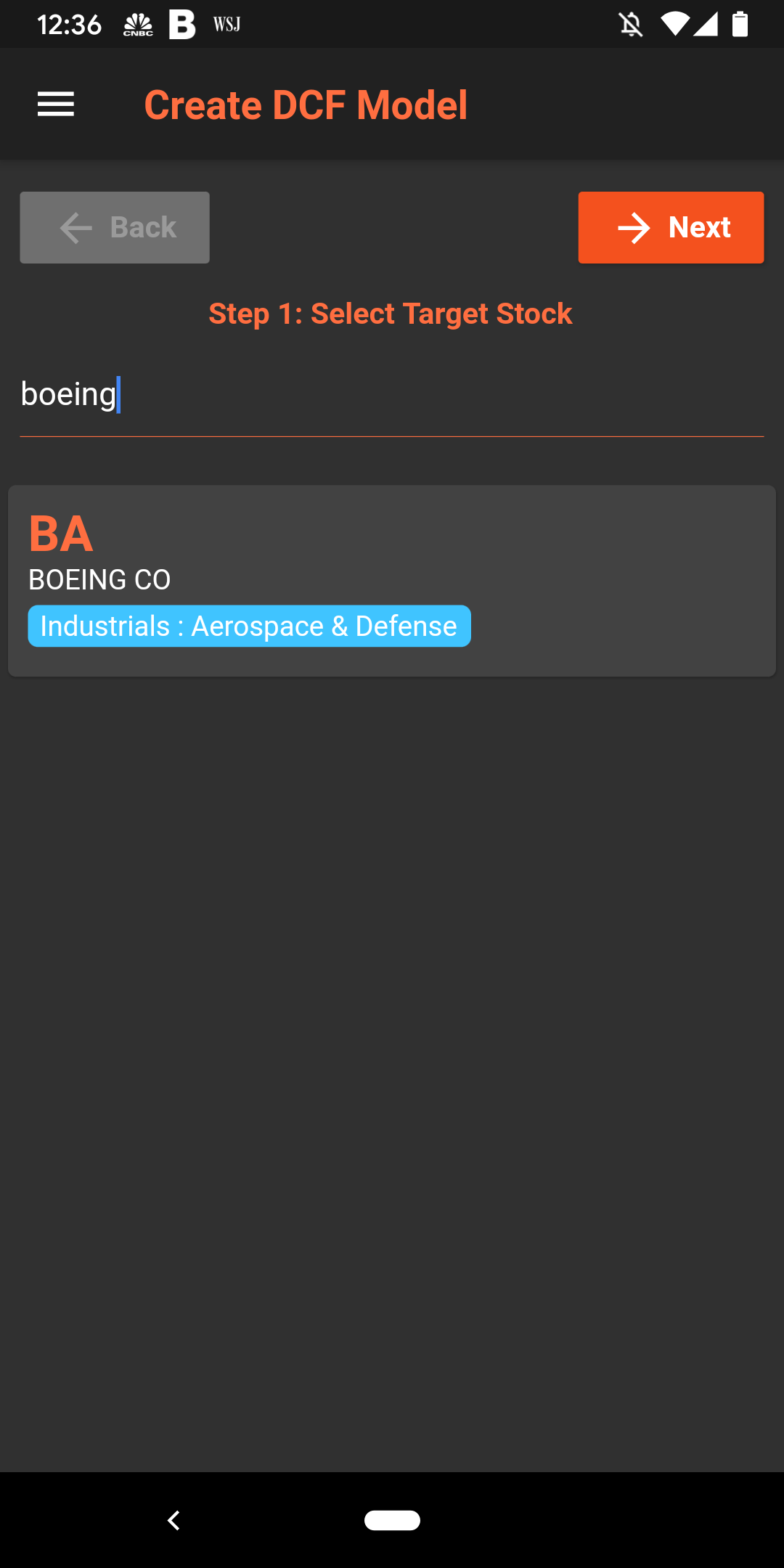

Step 1: Select your target stock. Here we will use Boeing as an example.

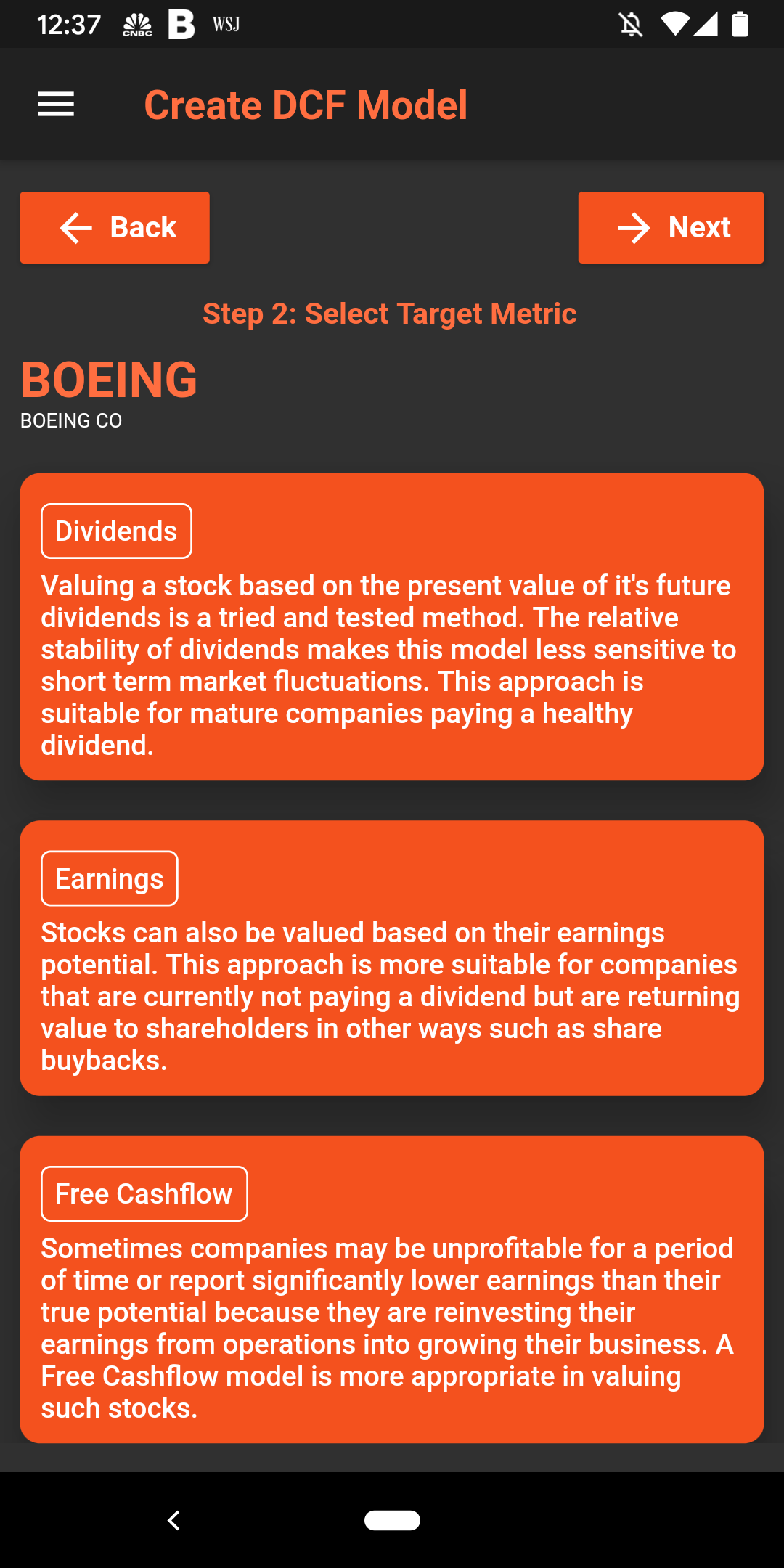

Step 2: Select your target Metric. Here we will use Free Cashflow to Equity (FCFE).

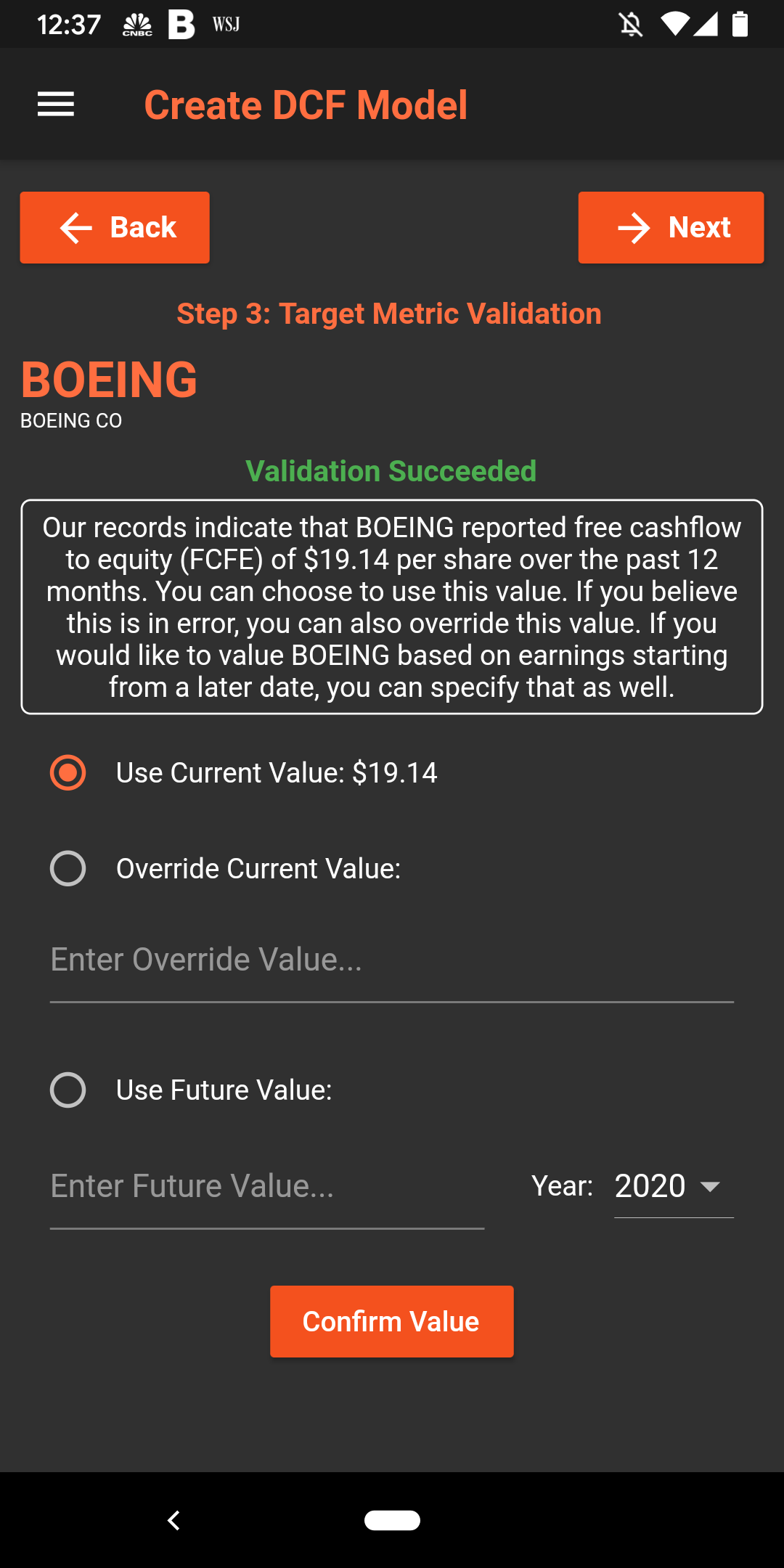

Step 3: We run some simple validation on your chosen metric (for eg, confirm the company is paying dividends if you chose that metric, validate that a company has positive earnings if you want to use earnings etc). You can choose to select the data we have on the company, override the data with your own value if you think our value is incorrect or even supply a value for a future time period.

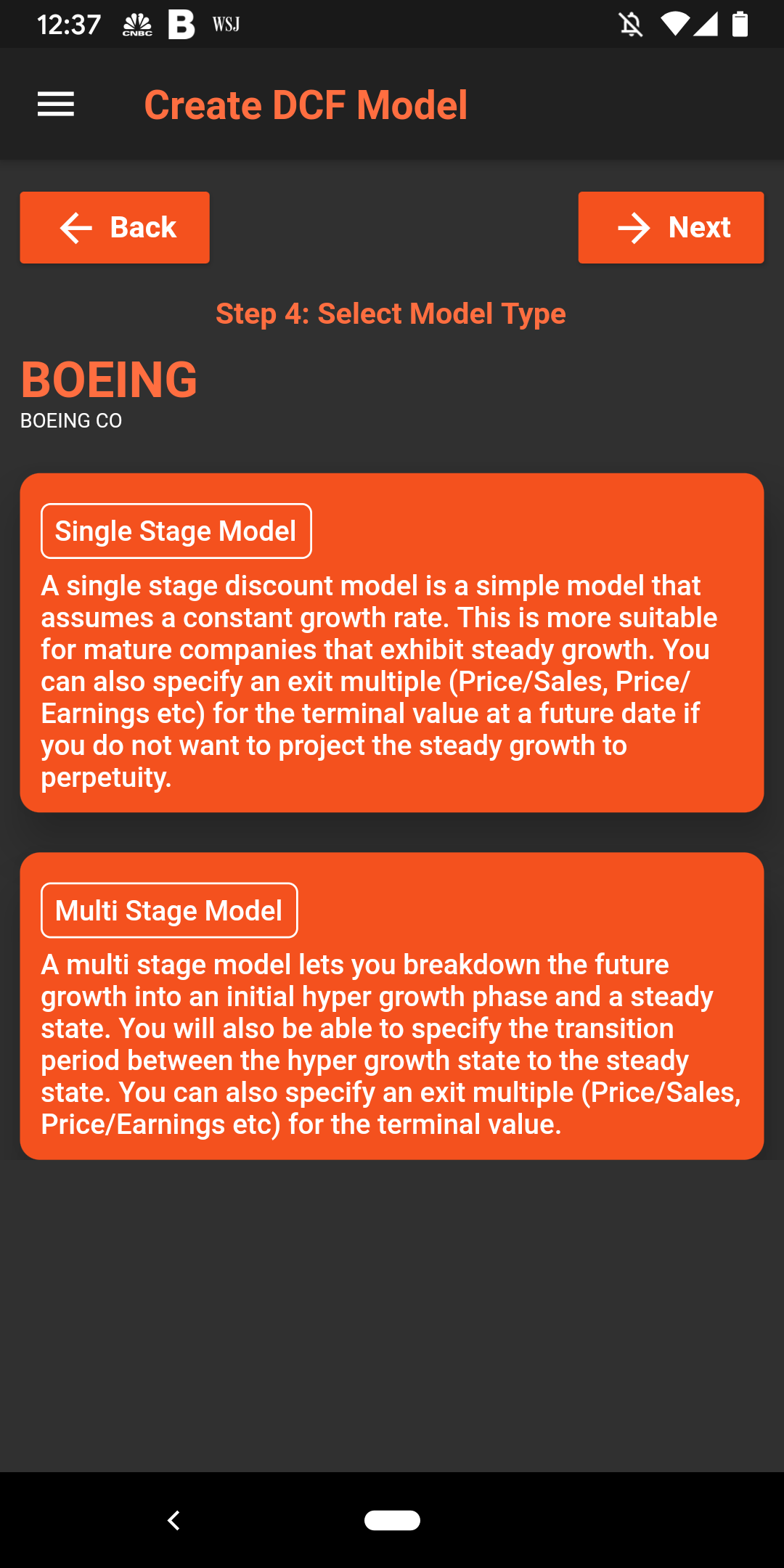

Step 4: You can select a single/multi stage DCF. A single stage is more approprite for mature companies. Here, we will use the multistage model.

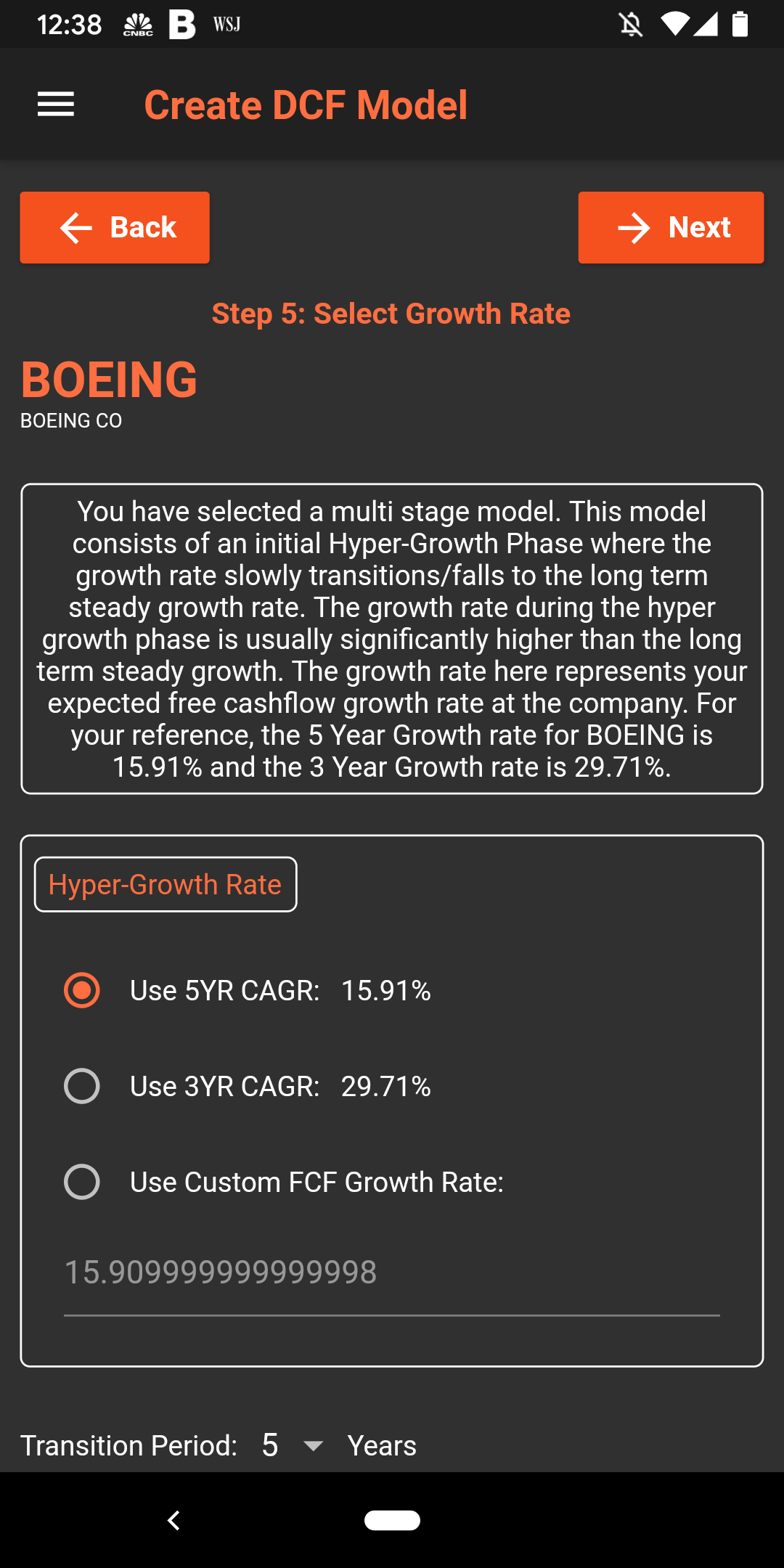

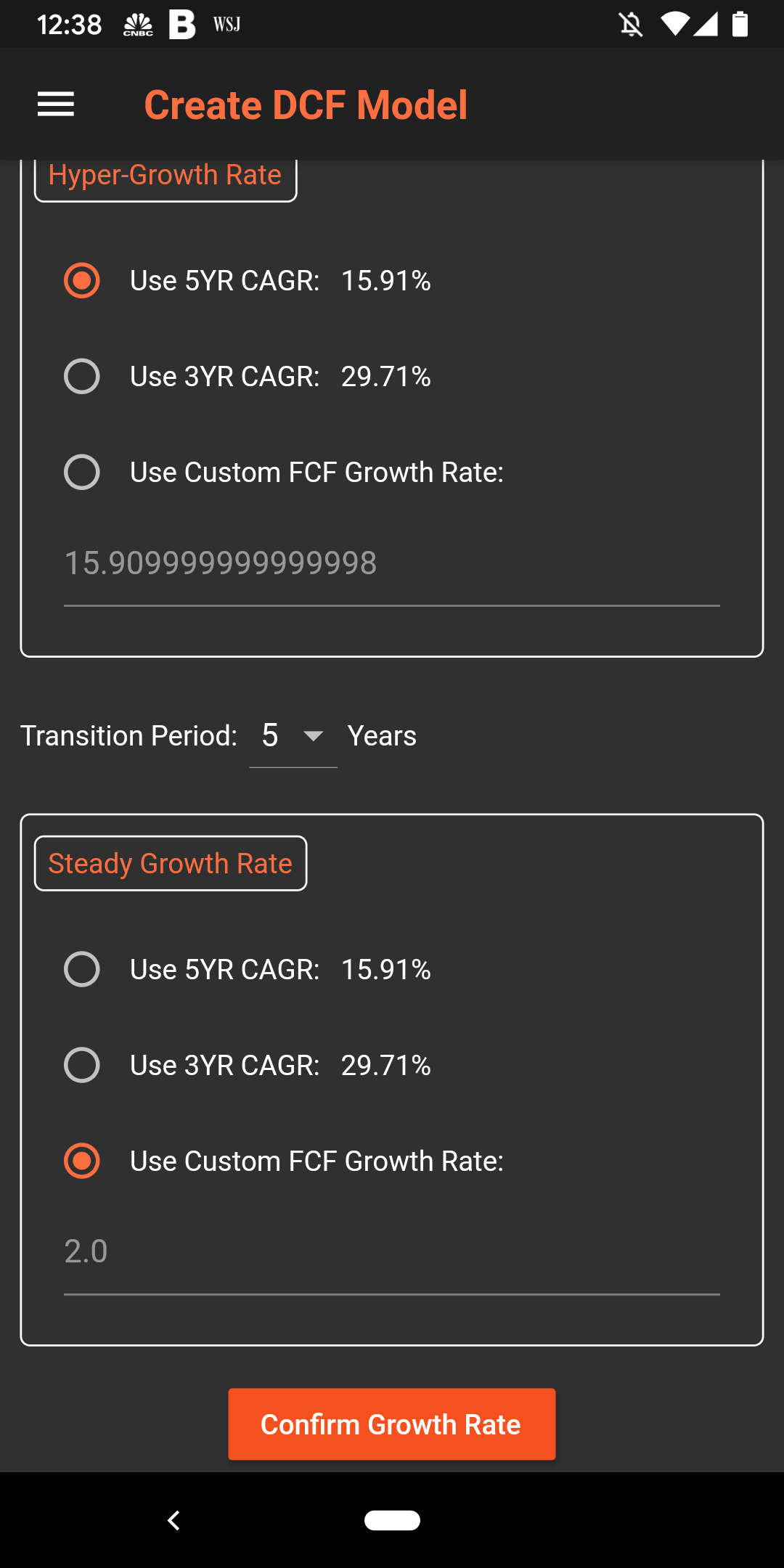

Step 5: Since we are using a multistage model in this example, we will need to specify a growth rate for the "Hyper Growth" phase and a value for longer term growth. You will also be able to specify how many years it will take to transition from the hyper growth rate to the steady growth rate.

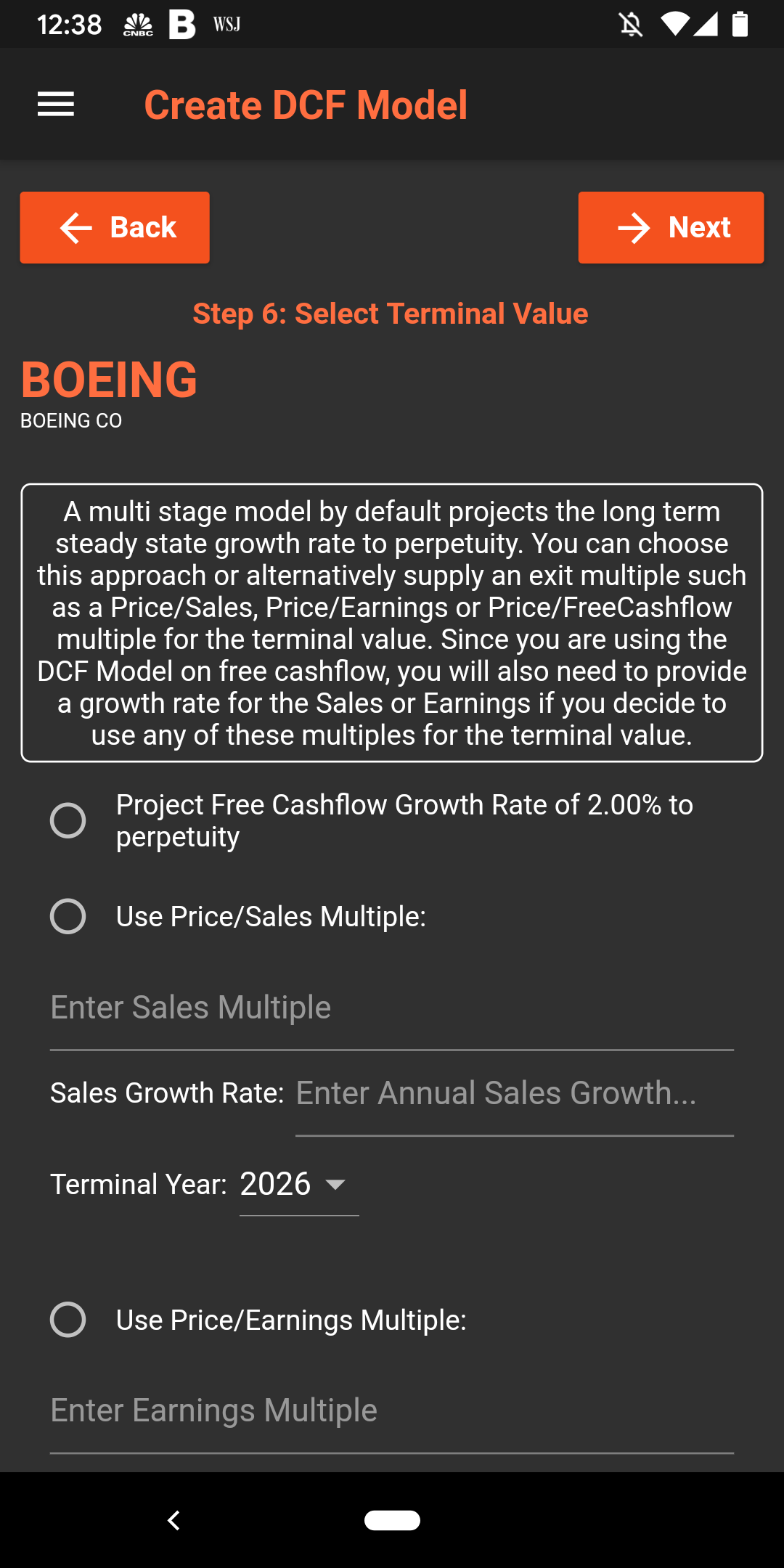

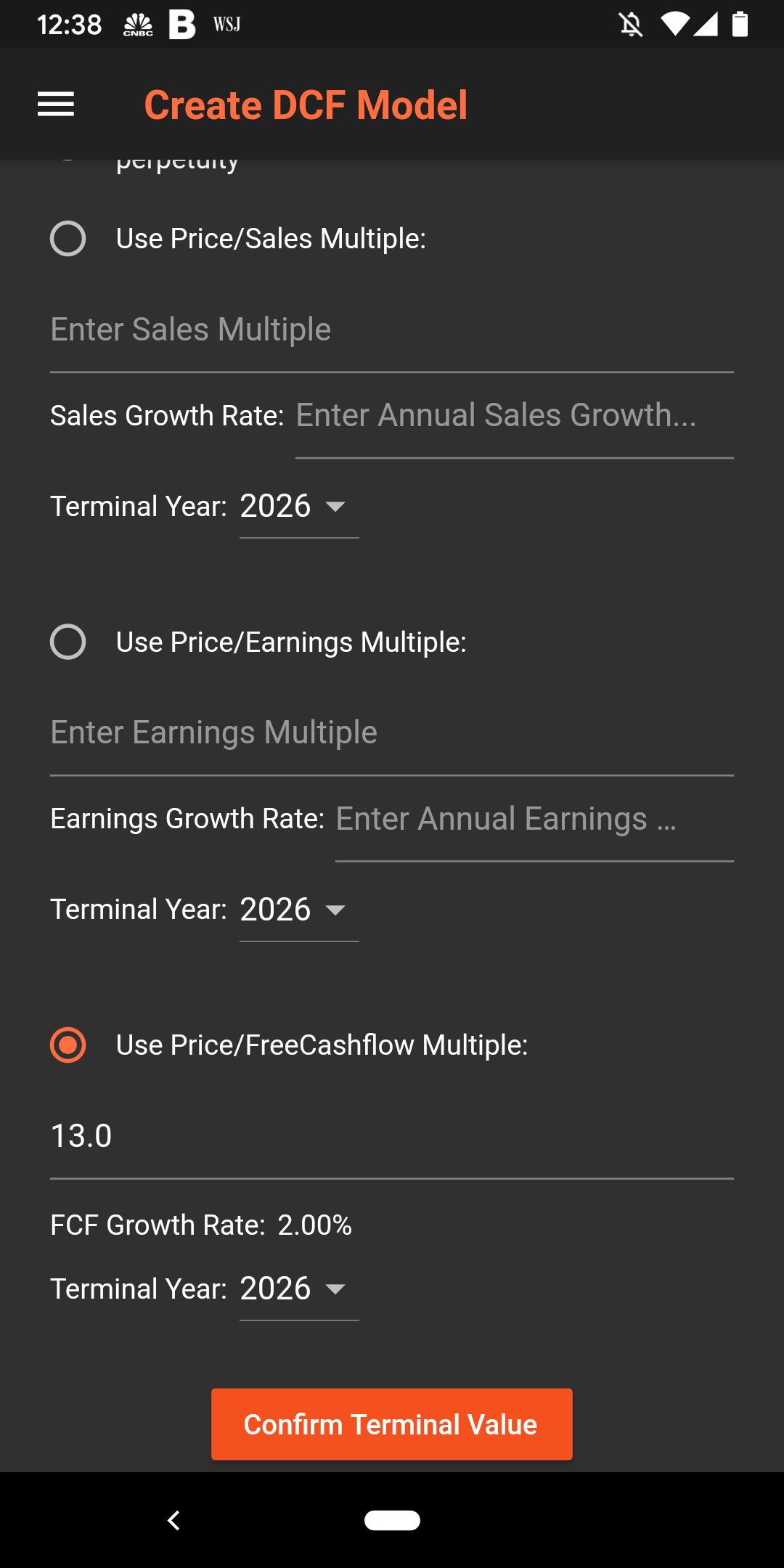

Step 6: By default, the long term growth rate is assumed to run to perpetuity. However, our DCF model also allows you to optionally specify an exit multiple. Here we will use a P/FCF exit multiple in 2026.

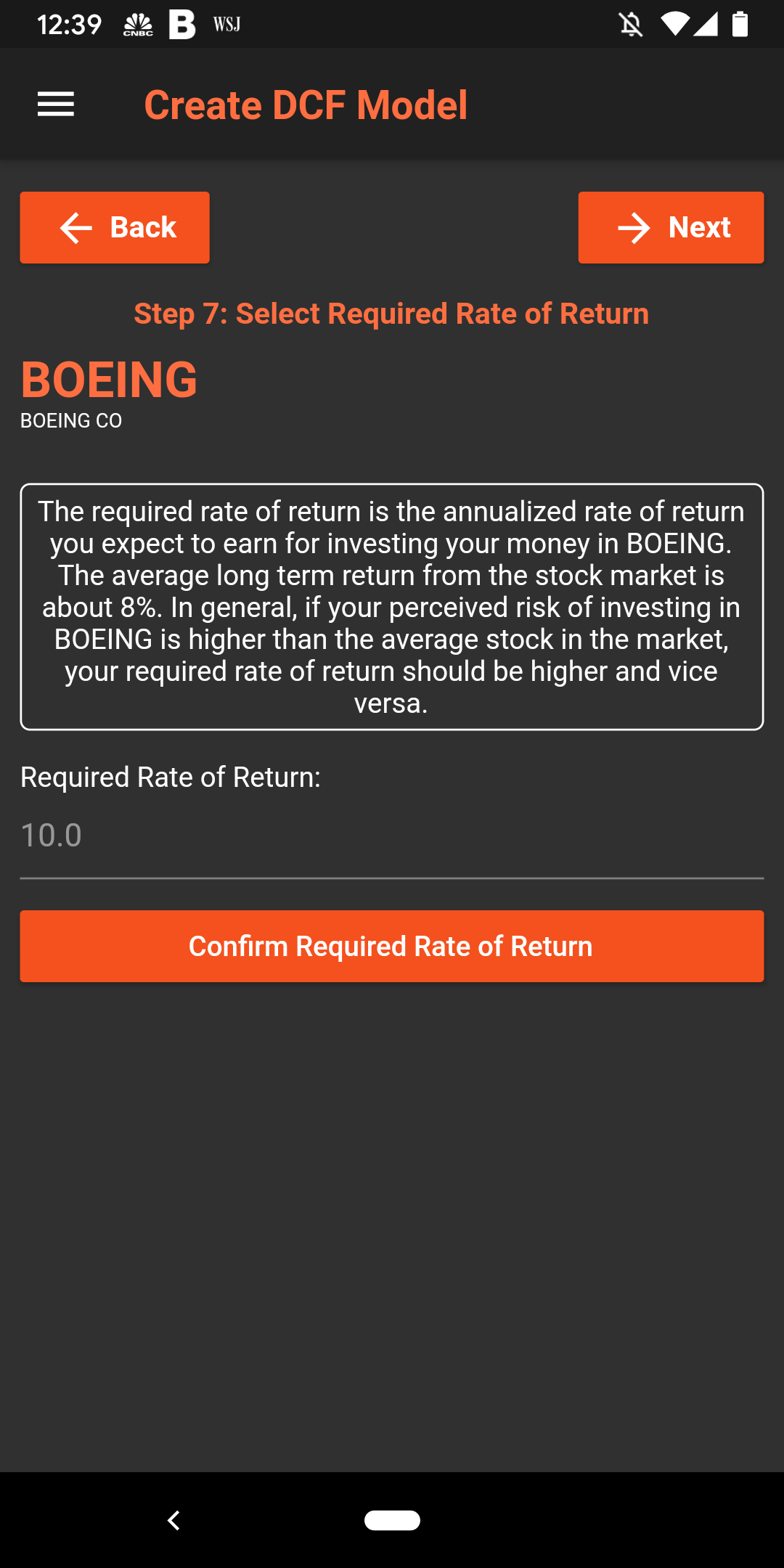

Step 7: Finally, we specify our expected rate of return for this investment. For more risky investments, you will want a higher return. If you are new to running DCF models, this assumption will have a big impact on your fair value calculations. You can try playing with different values to see the effect.

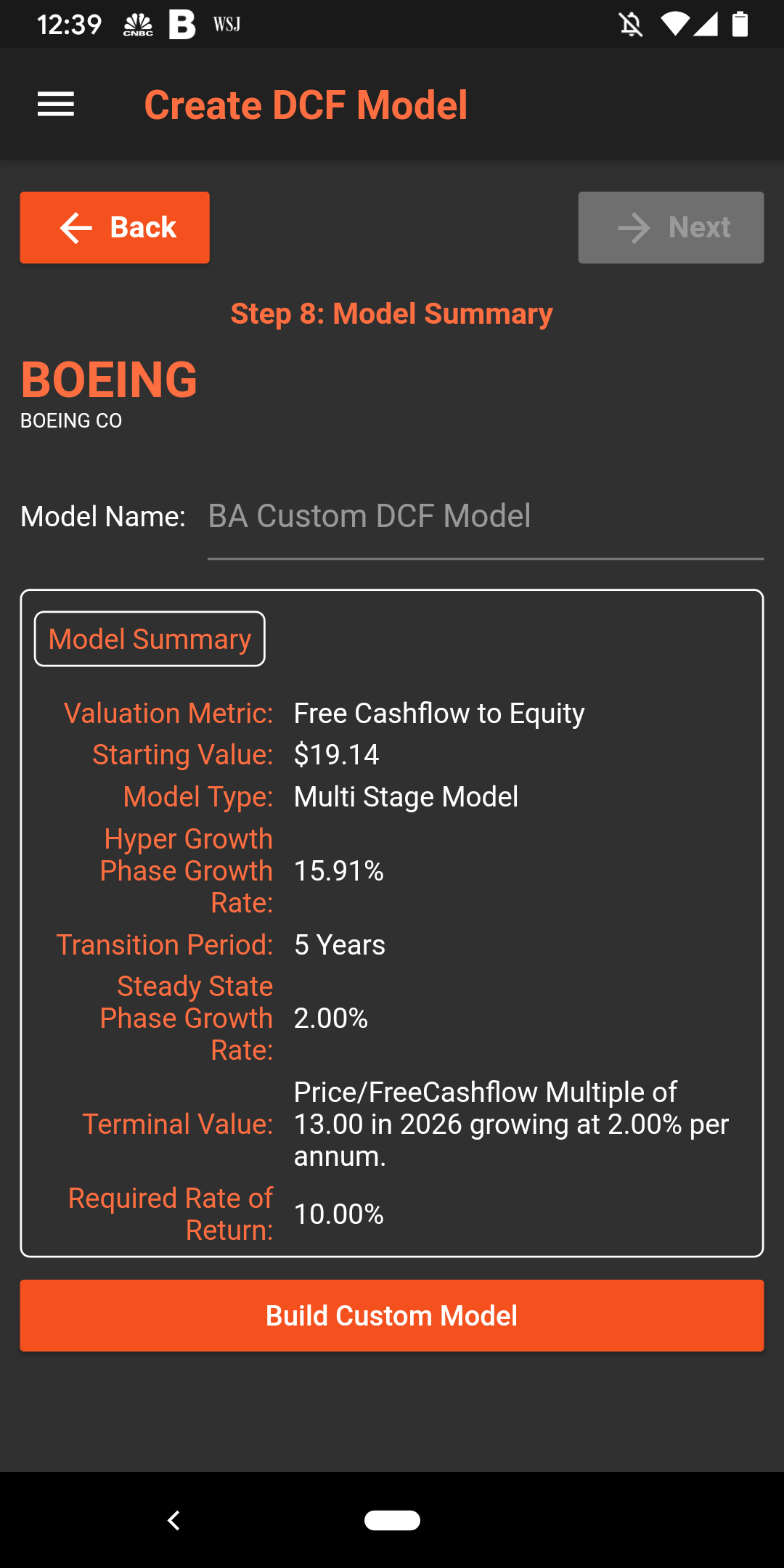

Step 8: Review the inputs to your model and hit submit!

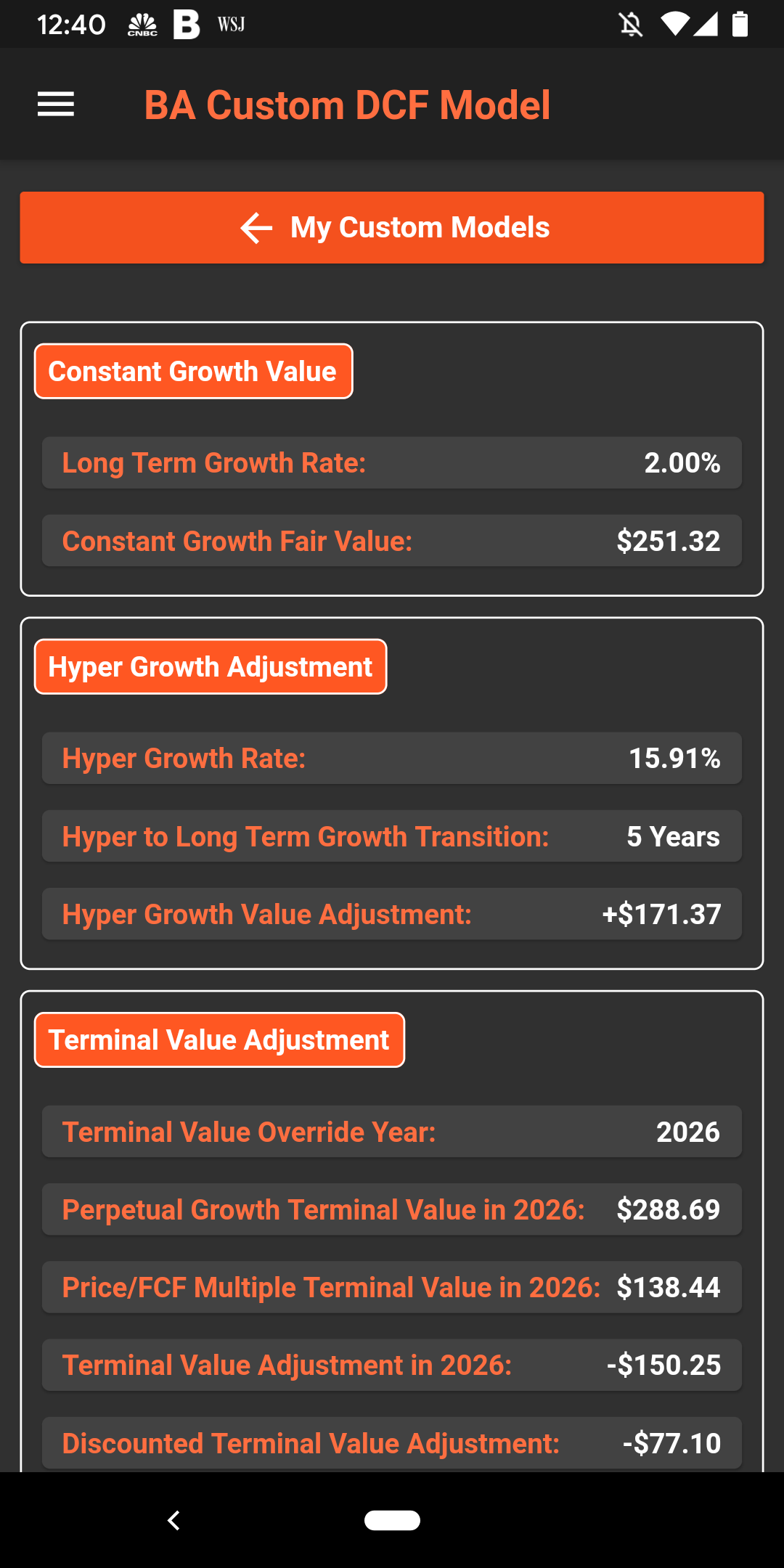

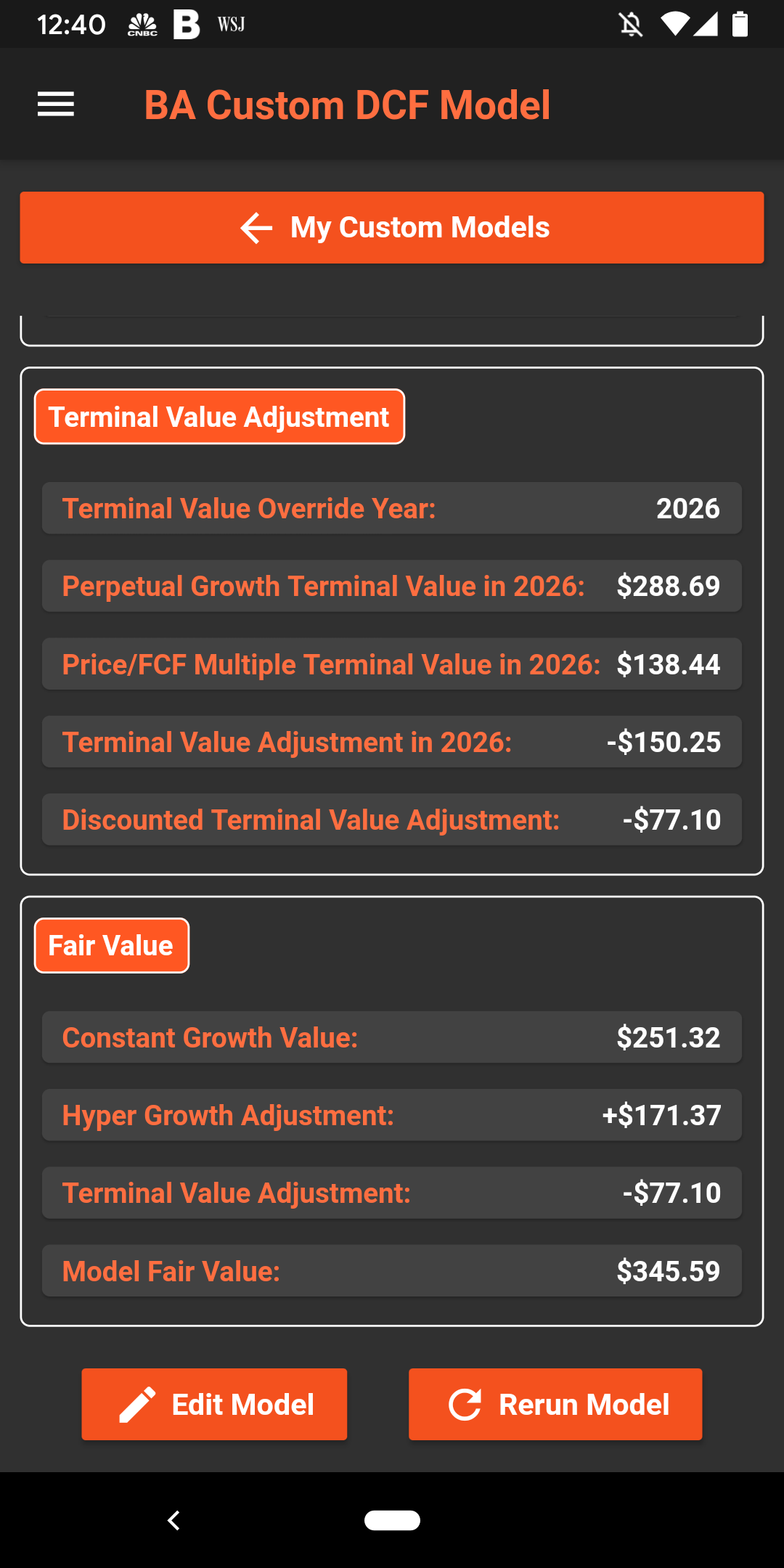

The processing should not take more than a few minutes based on the load on our servers. You will be able to see not only the current fair value estimate but also the details of how our model arrived at the fair value based on your input assumptions!