Build Your Own Custom Relative Value Model

Here is a quick primer on how to build your own sophisticated Relative Value Model using our free App "FundSpec" available on the AppStore and GooglePlay.

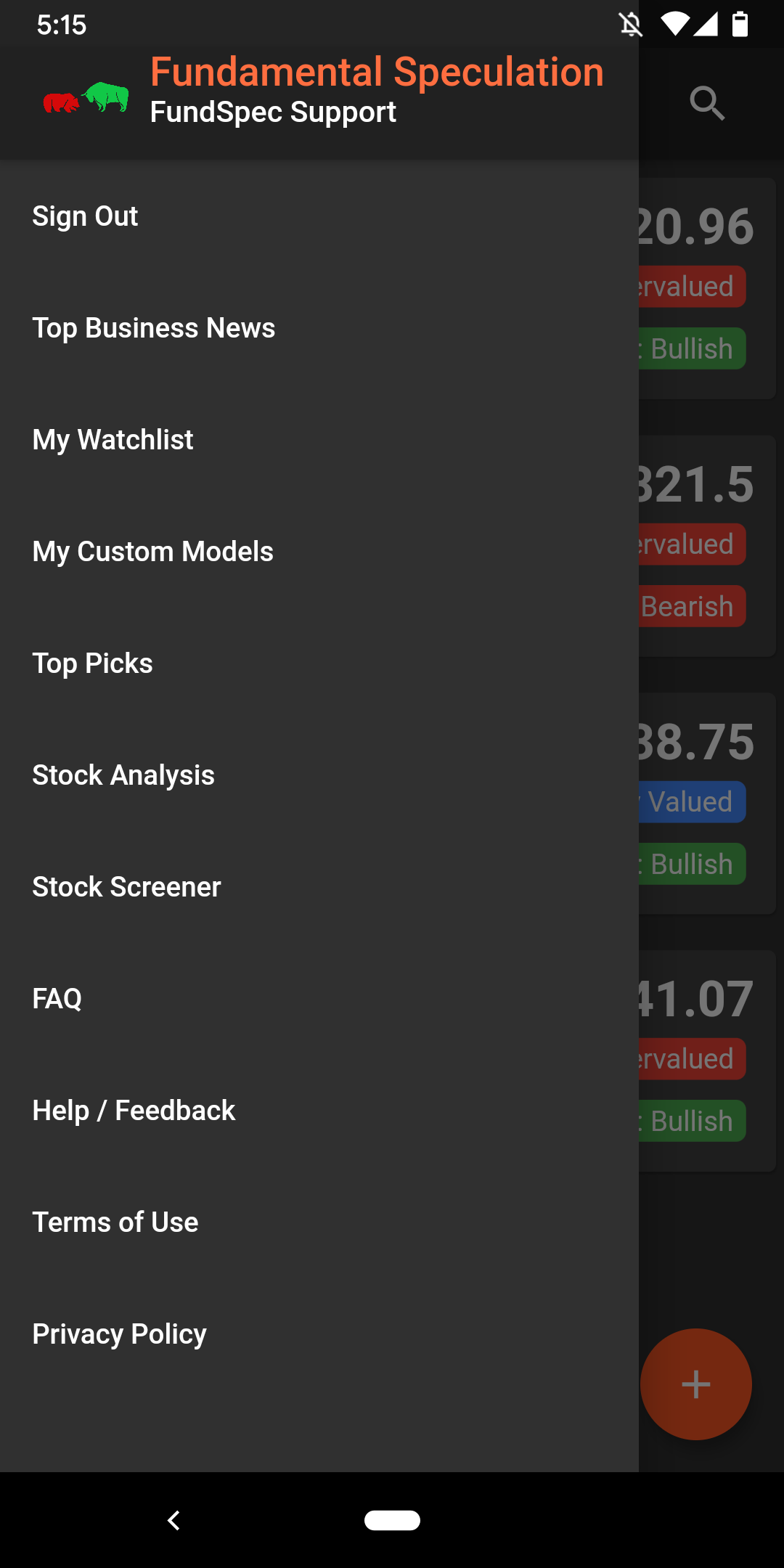

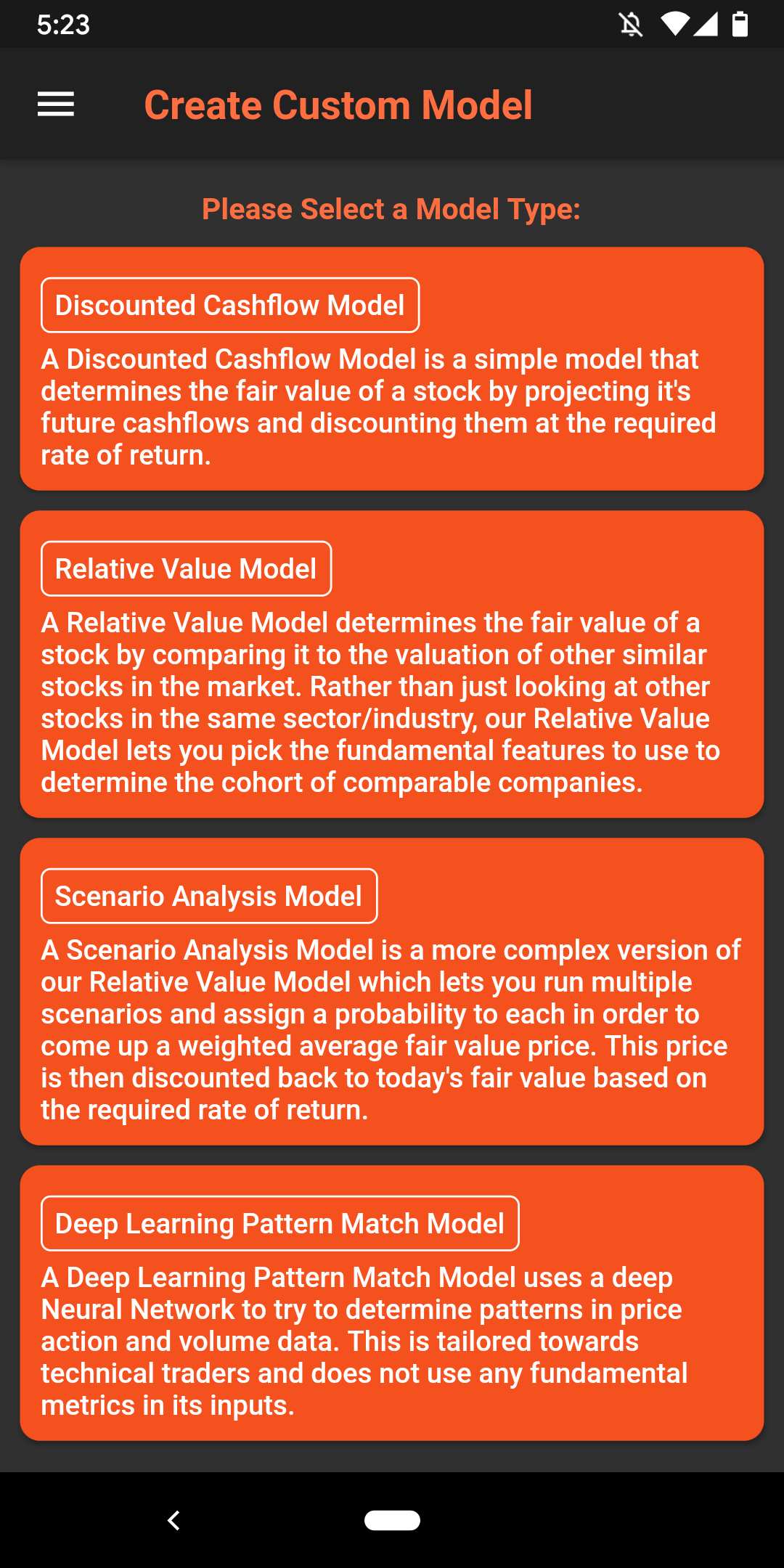

Step 0: Download our free app FundSpec on the AppStore & Google Play. Hit the menu button on the top left and select "My Custom Models" to create a new model. Select the Relative Value Model from the options shown.

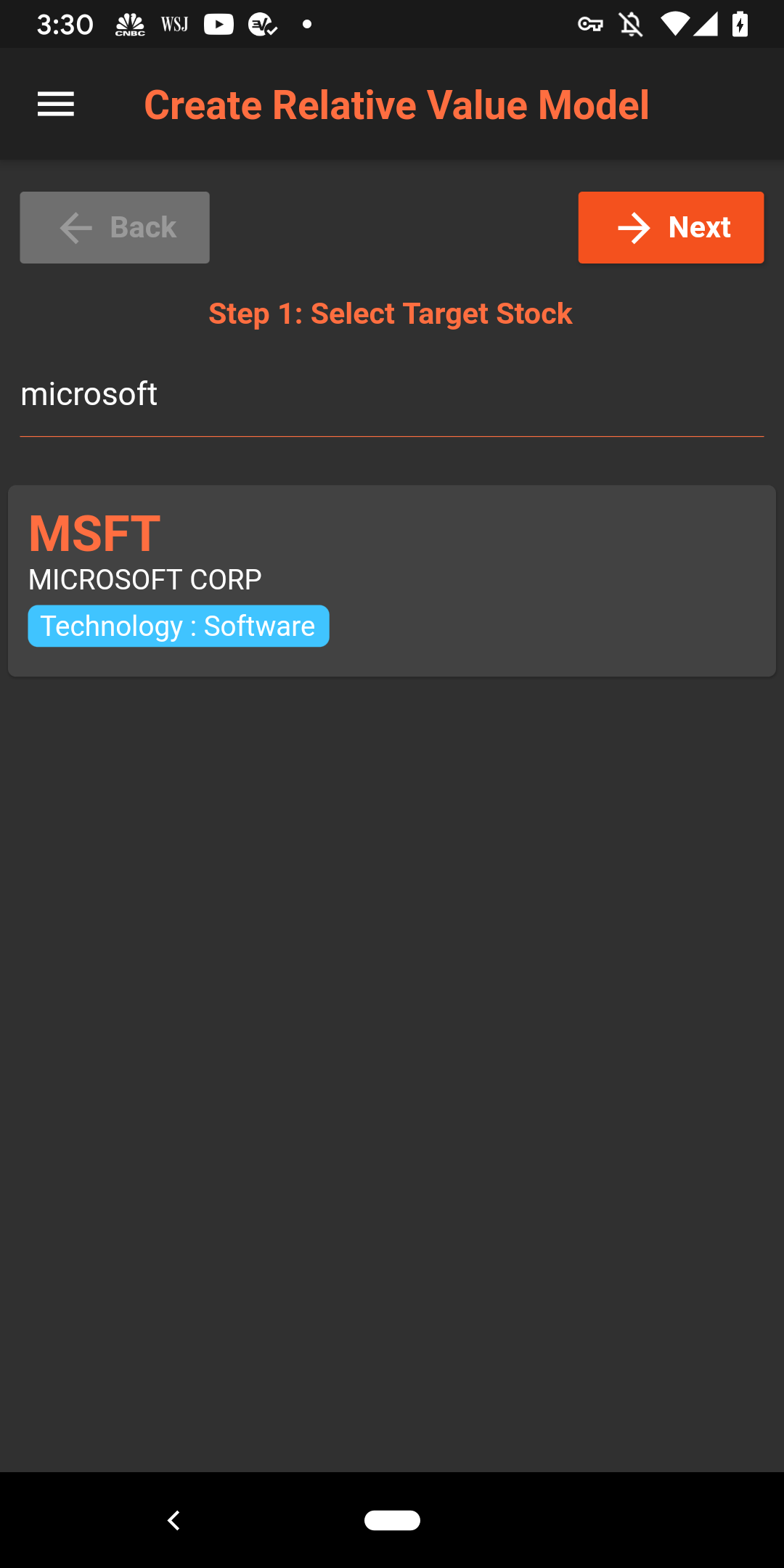

Step 1: Select your target stock. Here we will use Microsoft as an example.

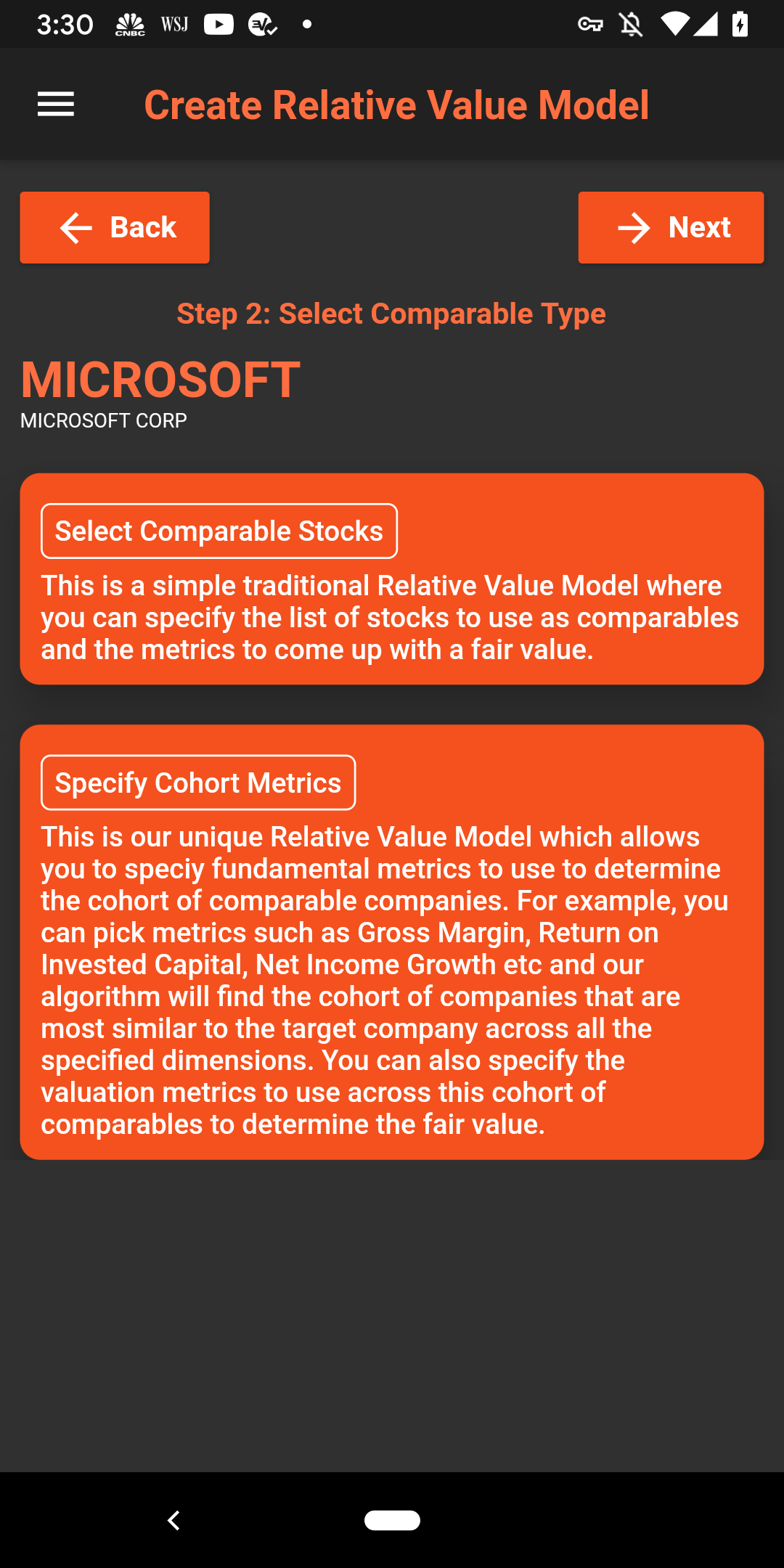

Step 2: Select your model type. You can choose to pick the comparable companies similar to a typical Relative Value Model or use our new sophisticated approach where you specify the fundamental metrics you want to use to determine your cohort and we will identify the list of comparable companies that most closely match your target company. In this example, we will illustrate the cohort metrics approach.

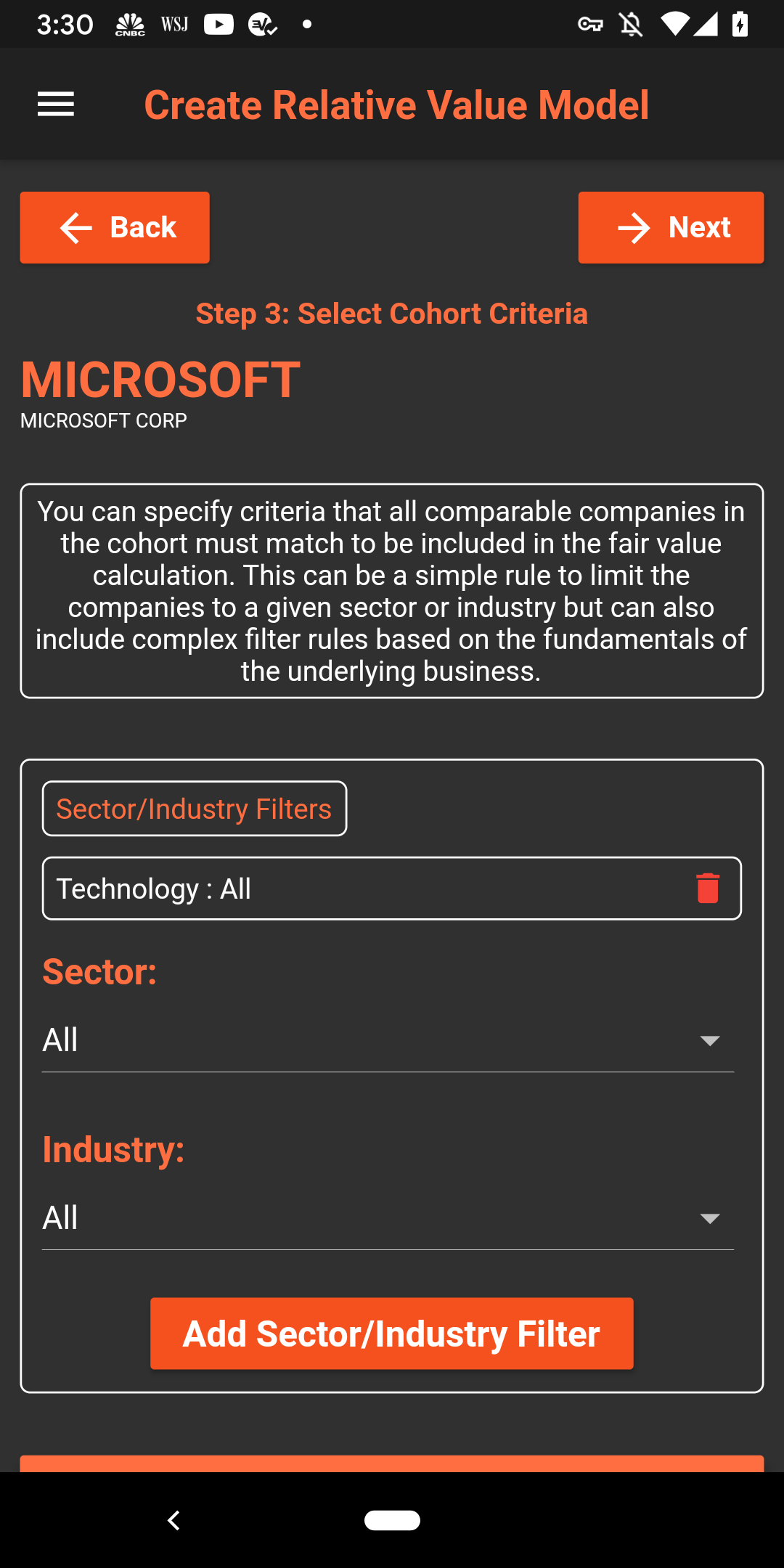

Step 3: You can now specify which sectors/industries you want to limit your comparables to. In this case, since our target company is Microsoft, we will limit the search to all companies in the Technology sector.

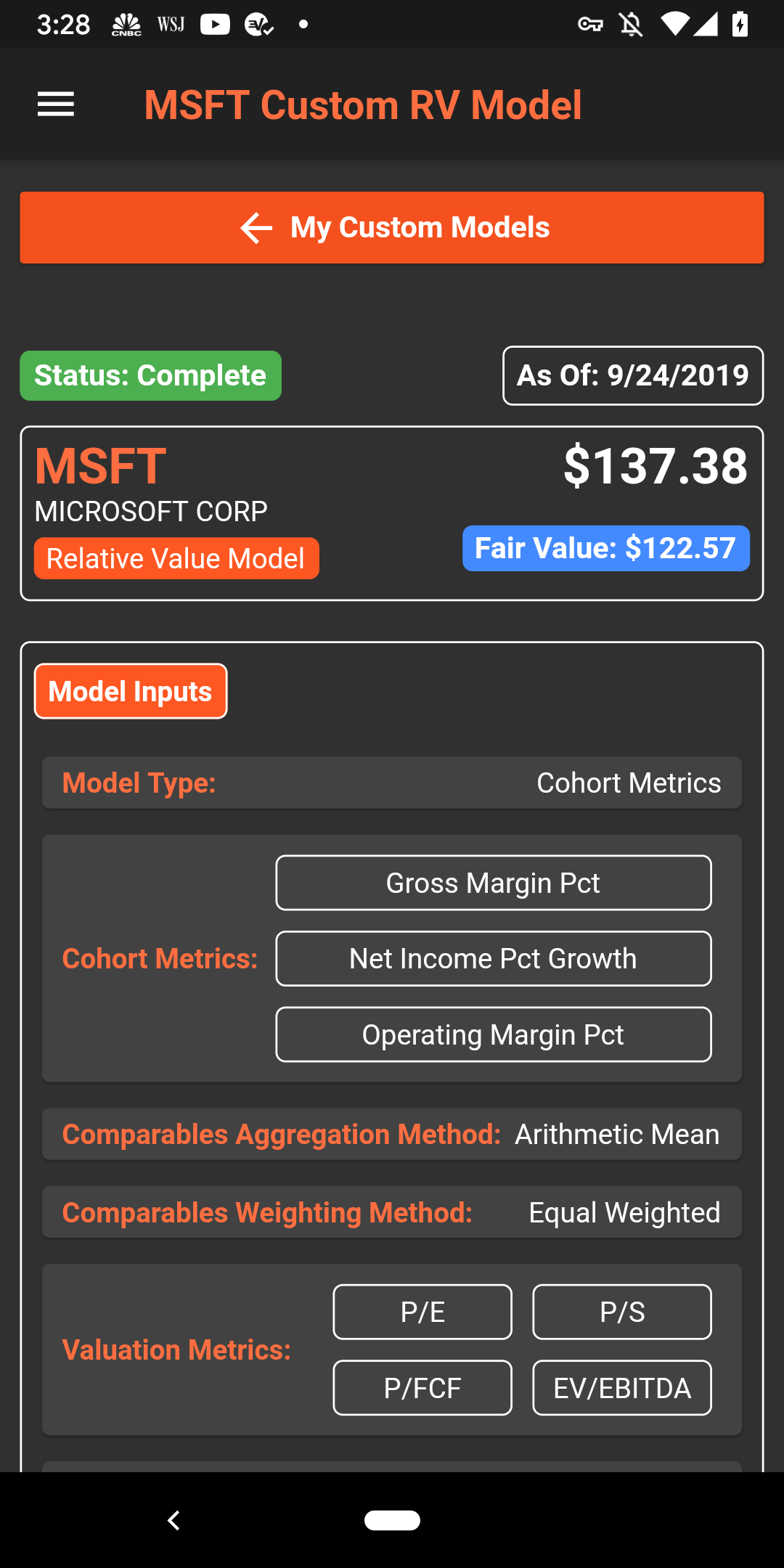

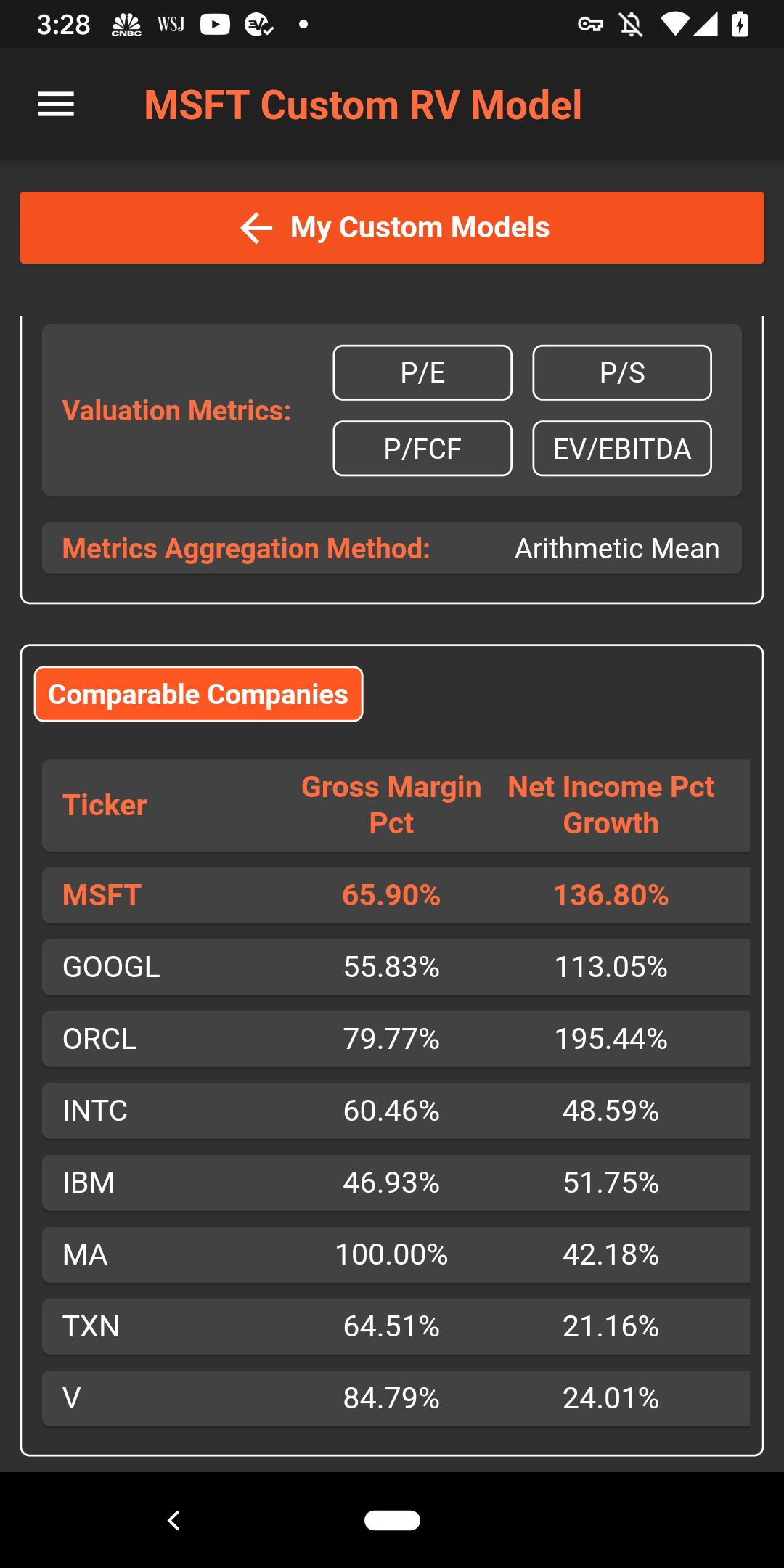

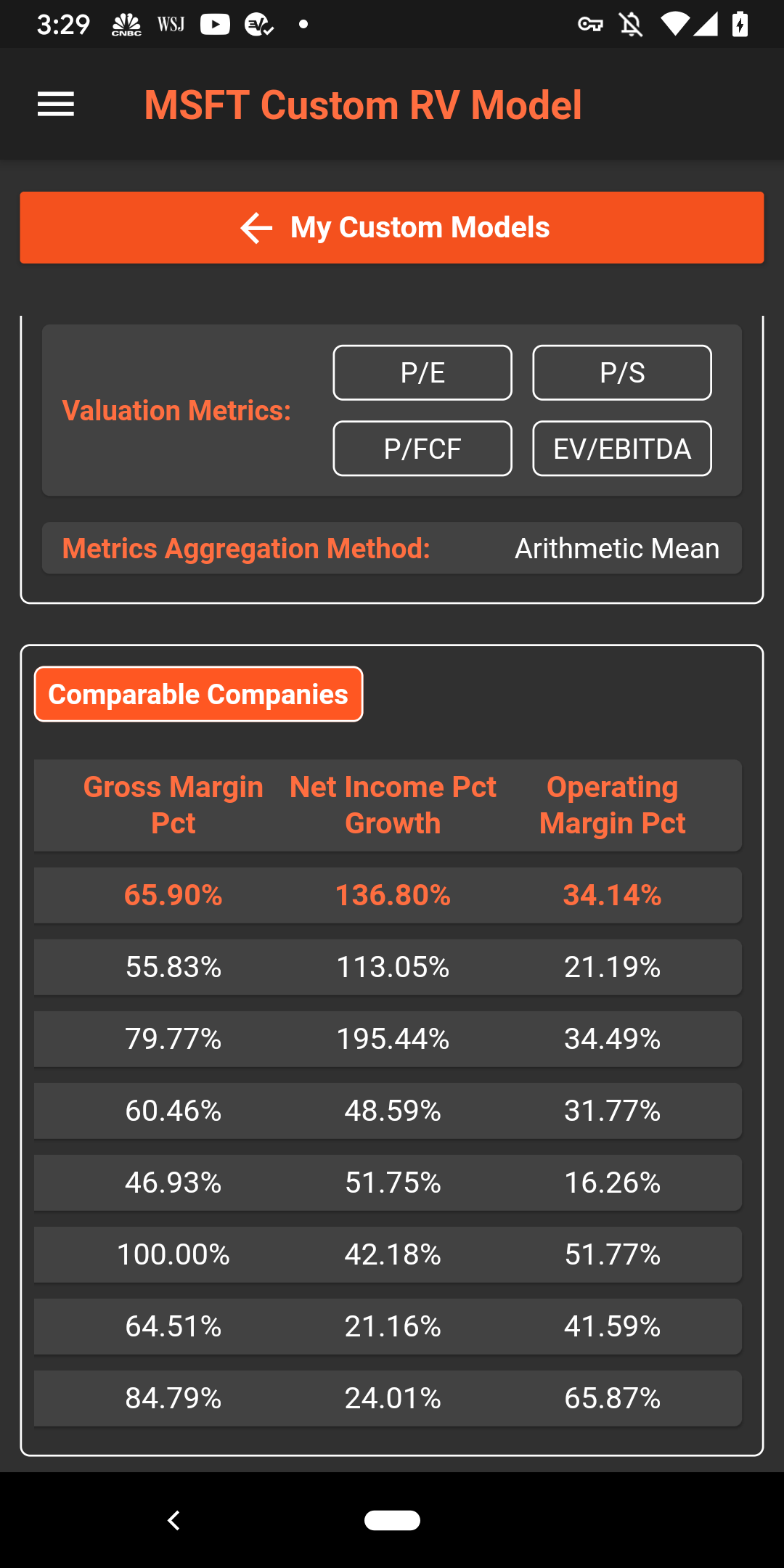

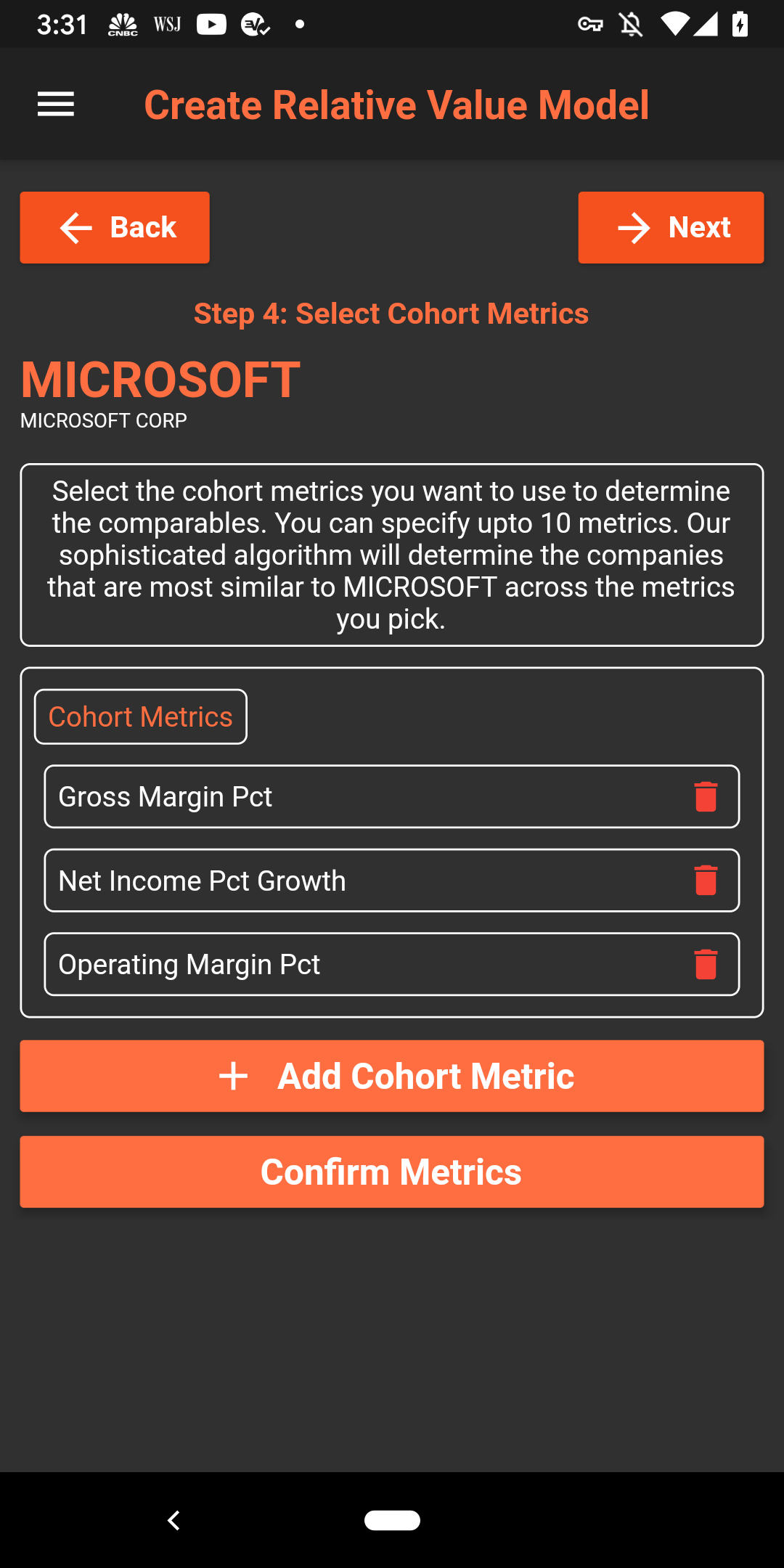

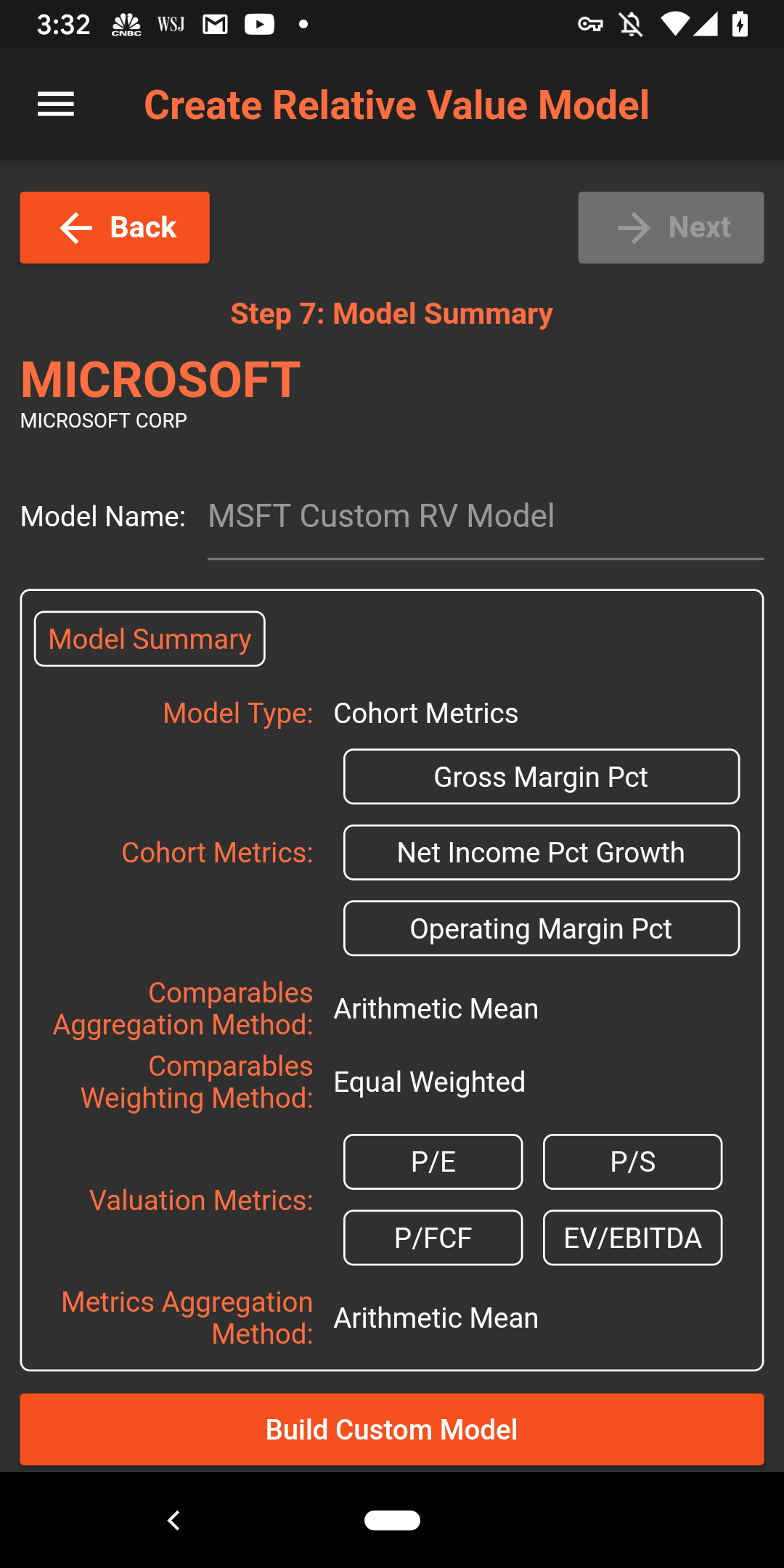

Step 4: Next, you pick the list of fundamental metrics you want to use to search for comparable companies. In this case, our algorithm will try to find comparables that most closely match Microsoft in Gross Margin Percent, Net Income Percent Growth and Operatiing Margin Percent.

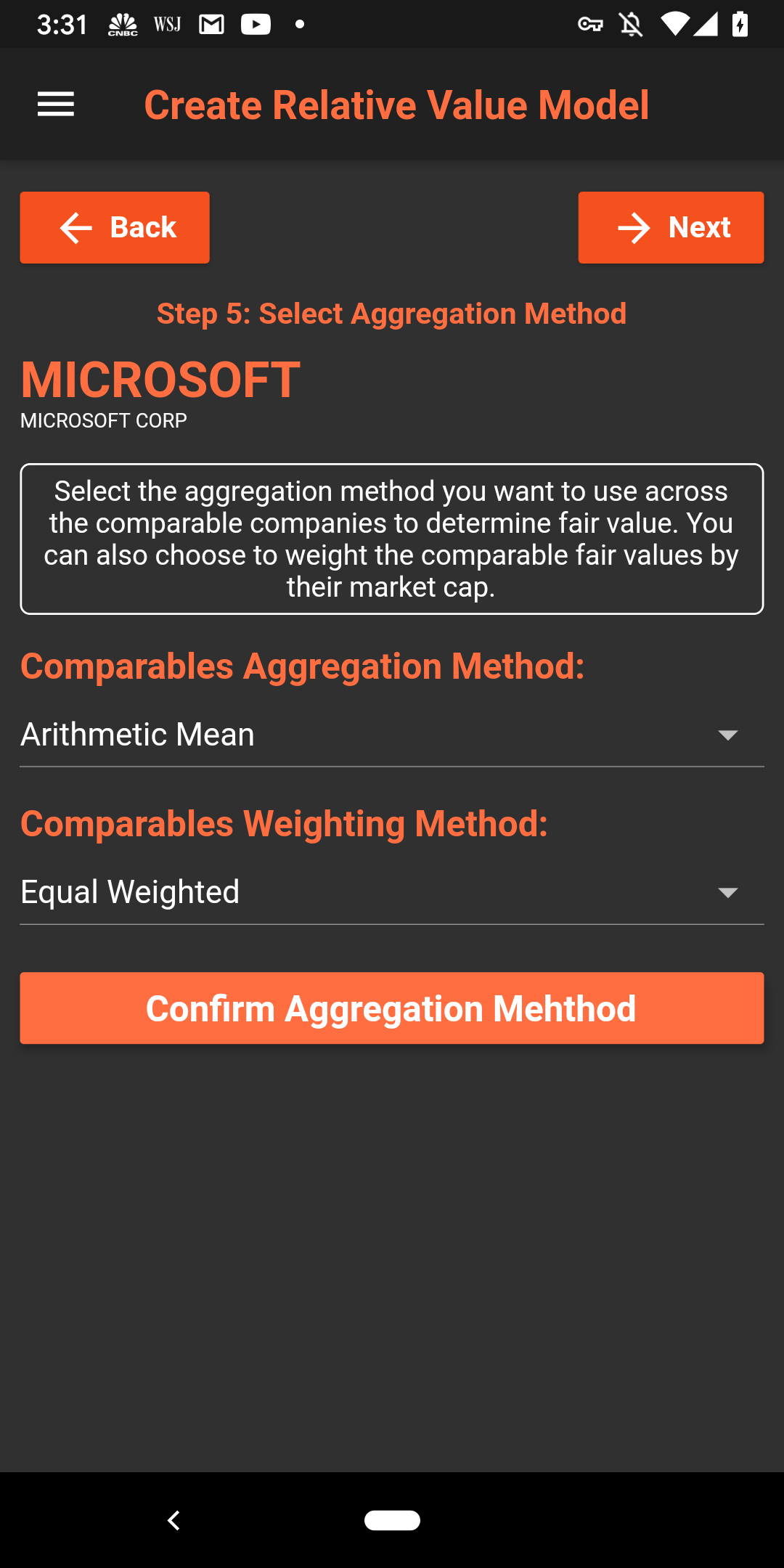

Step 5: Now we pick how we want to weight our fair value estimates from the comparable companies. We can use an Arithmetic Mean, Geometric Mean or a Harmonic Mean. In this case we will use the Arithmetic Mean. We can also choose to equal weight the fair values or use a market cap weighting. In this case, we will use equal weighting.

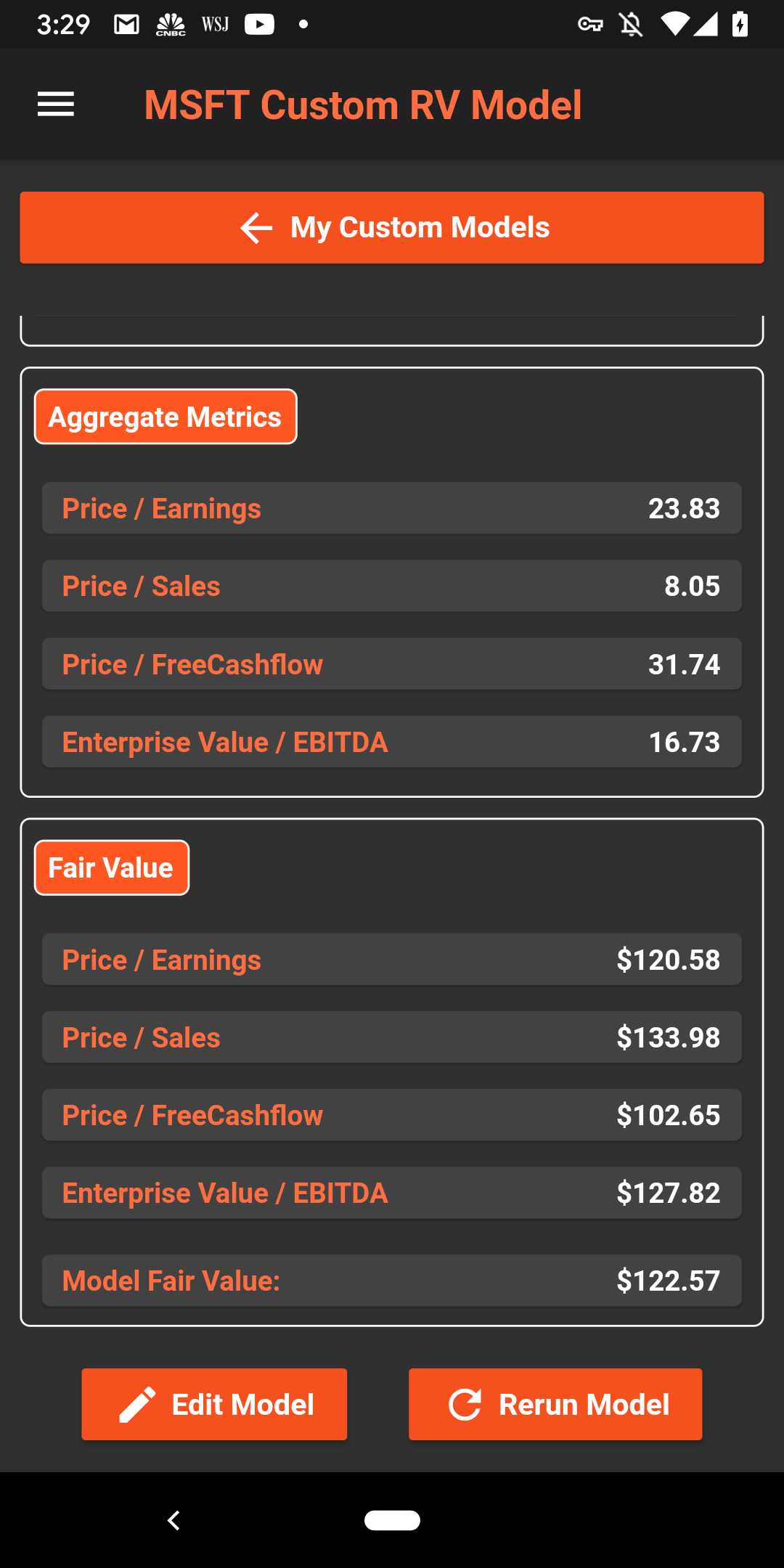

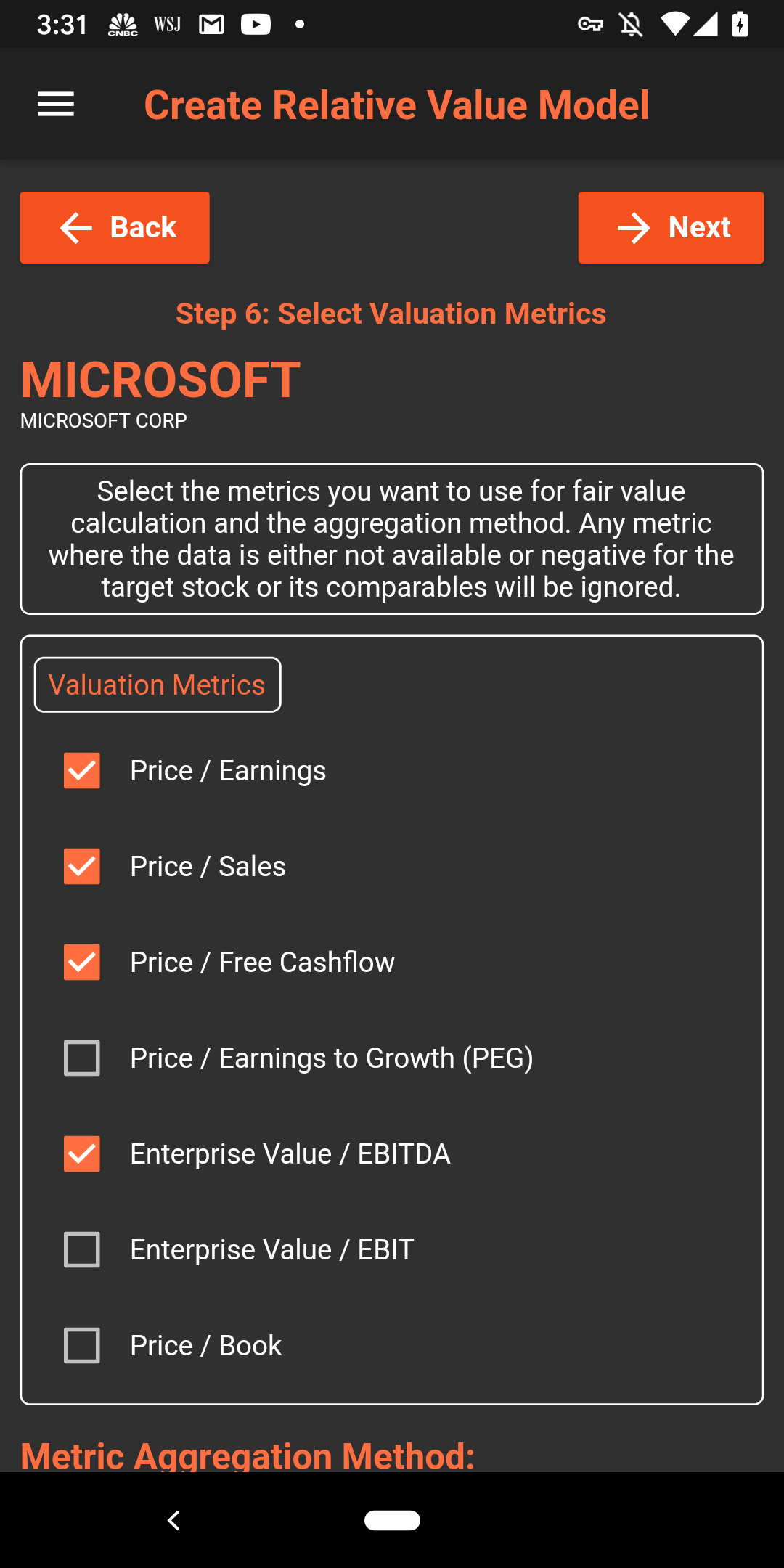

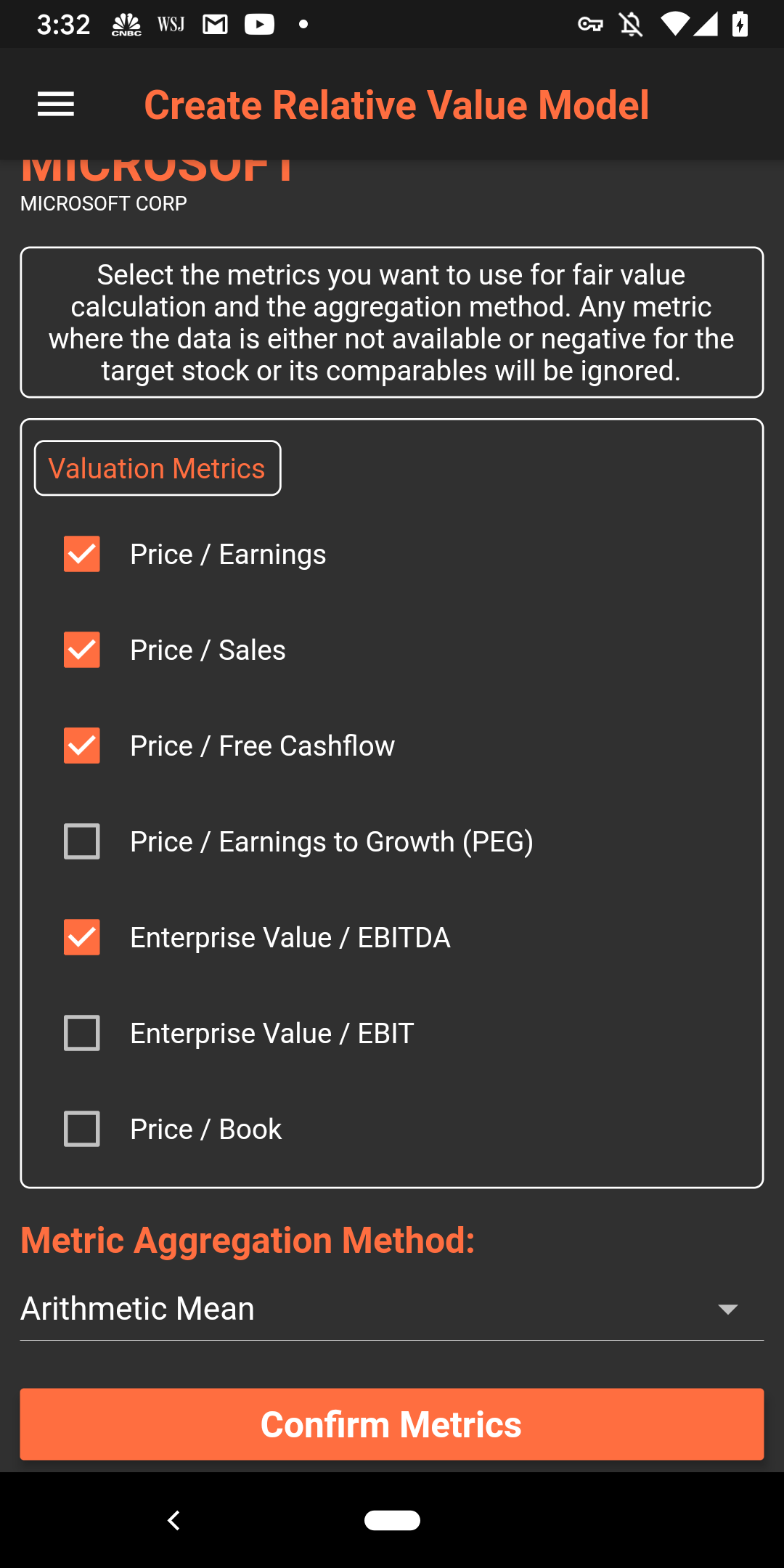

Step 6: Pick the valuation metrics you want to use to determine the fair value. Here we use P/E, P/S, P/FCF & EV/EBITDA. Since we are using multiple metrics, we will also need to select a way to aggregate the values. In this case, we will just use the Arithmetic Mean.

Step 7: And we are done! Review all the inputs to your model and hit Submit!

The processing should not take more than a few minutes based on the load on our servers. Our sophisticated algorithm will determine the list of companies that most closely match your target company in terms of the fundamental metrics you have chosen within the sectors/industries you have limited the search to. This represents the true cohort of comparable companies for your relative value analysis. The model will also produce an estimate for the relative fair value determined based on the valuation metrics you have chosen.